2025 Themes: The Bill Comes Due

The bill comes due for the FOMC bond buying and fiscal spending boom

2025 Themes: Pandemic Policy Backlash

FOMC Resistance

The Bill for Fed Bond Buying & Government Spending Comes Due

Global Current Account Rebalancing

A Mar-a-Lago Accord?

2024 Themes: The Debt Shadow

The Fiscal Limit

The Petrodollar

Demographics are Destiny

Productivity Boom

2023 Themes: Macro Themes for '23 and Beyond

The Battle of the Bonds

Globalization: Descending into Darkness?

Technology & Energy: Revenge of the Old Economy

2022 Themes: Macro Themes for the '20s Cycle

‘60s or ‘70: Length of the Cycle

The End of US Equity Market Outperformance?

Power to the People

The Natural Rate of Interest

2021 Themes: Macro Themes for 2021 & Beyond

Echoes of the ‘60s

Schumpeter’s Gale: The Pandemic

Rebuilding the US Capital Stock

Deglobalization, Collectivism and Mercantilism

The End of the 39-Year Bond Bull Market

2020 Themes: Macro Trends for 2020 & Beyond

Deglobalization

Capitalism, Socialism and Mercantilism

Energy & ESG

Interest Rate Suppression

Thematic Review

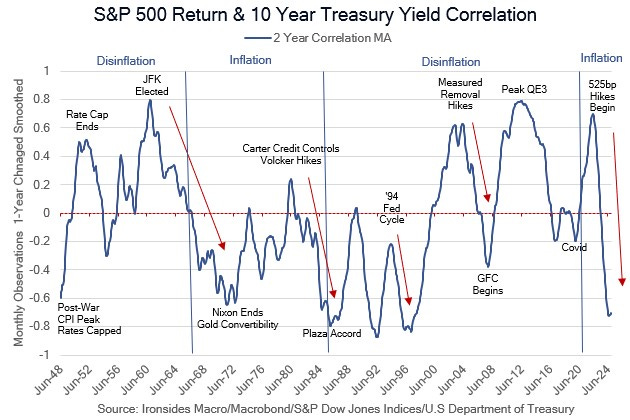

The most consistent theme in our annual macro themes notes over the last four years, and again this year, has been the end of the 39-year bond bull market, and the second post-war secular bond bear market. This year’s note focuses on the pandemic policy panic that led to a bloated Fed balance sheet, record levels of government spending and the largest US quarterly current account deficit on record, bill coming due. The Biden Administration and Federal Reserve left the incoming Trump economic team with a debt management quagmire. The problems are so consequential that they are likely to impact asset prices through the balance of the decade. Government spending and the Fed’s securities held outright at 24% of GDP cannot be reduced to levels that stabilize the most important price in the global capital markets system, the dollar price of the 10-year Treasury, with a single reconciliation bill or FOMC meeting. Both the federal government and Federal Reserve need to be restructured, business as usual with different leadership, is unlikely to be sufficient to stabilize government debt. More likely bond vigilantes and exchange rate crises for export dependent energy starved economies and emerging market nations with large dollar denominated debt will be required as forcing mechanisms. It is often said Congress never does anything without a crisis. The US economy is the most dynamic and innovative major economy, our 2025 Outlook: Targeting a Trifecta, discusses our optimistic outlook for capital investment and productivity, this note covers the pandemic policy mistakes that are the biggest threat to US prosperity. We believe we are entering a period of dramatic policy change faced with the largest risks since the end of the dollar gold standard in 1971.