2024 Themes: The Debt Shadow

The fiscal limit, petrodollar, demographics and productivity boom

2024 Themes: The Debt Shadow

The Fiscal Limit

The Petrodollar

Demographics are Destiny

Productivity Boom

2023 Themes: Macro Themes for '23 and Beyond

The Battle of the Bonds

Globalization: Descending into Darkness?

Technology & Energy: Revenge of the Old Economy

2022 Themes: Macro Themes for the '20s Cycle

‘60s or ‘70: Length of the Cycle

The End of US Equity Market Outperformance?

Power to the People

The Natural Rate of Interest

2021 Themes: Macro Themes for 2021 & Beyond

Echoes of the ‘60s

Schumpeter’s Gale: The Pandemic

Rebuilding the US Capital Stock

Deglobalization, Collectivism and Mercantilism

The End of the 39-Year Bond Bull Market

2020 Themes: Macro Trends for 2020 & Beyond

Deglobalization

Capitalism, Socialism and Mercantilism

Energy & ESG

Interest Rate Suppression

Thematic Review

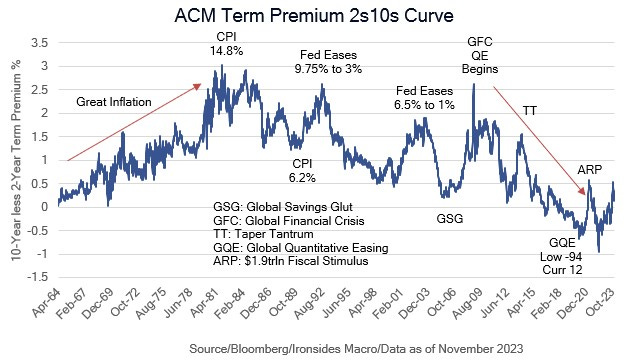

One consistent theme in our annual macro themes notes has been Federal Reserve large-scale asset purchases causing nominal, real and interest rate volatility suppression. Yet 2023 was the year the chickens really came home to roost, not so much due to the Fed’s passive balance sheet contraction program, but instead because the federal government reached its fiscal limit. While we are in the midst of a ferocious bull steepening rally in Treasuries attributable to the end of the most aggressive rate hike cycle since the Volcker Fed, the larger problem of unsustainable debt and deficits is unlikely to be resolved by Treasury issuance tactics, Federal Reserve rate or balance sheet policies, at least not without additional costs.

Additional themes we have focused on in our annual thematic notes include deglobalization and struggles for export dependent economic models (mercantilism), the positive effect of the energy transition on fossil fuel producers, US equity market outperformance, and accelerated productivity growth. In this year’s note we are going to explore the next phase for the bond bear market, the impact of the US emergence as the world’s largest energy producer, the outlook for capital spending, technology innovation adoption and productivity and a discussion of demographics as the Millennials reach peak household formation and consumption.

The Fiscal Limit

The Federal Reserve was created by the Wilson Administration and Congress, not the founding fathers. During our four decades in the markets, the Federal Reserve has had a degree of independence far greater than in the prior five decades. Market participants, generally speaking, take Fed independence as a given, but as we discussed in There's a New Sheriff in Town, the actions of Treasury have had a much greater impact on markets since ‘21 than at any other point during the Fed independence era that began with Chairman Volcker. Notably, instability in the Treasury market in September ‘22, March ‘23 and during the August-October ‘23 bear steepening, were followed by the FOMC reducing the size of hikes, slowing the pace, then finally pivoting, despite an unemployment rate below their estimate of u*, the equilibrium rate. The politics of the highest level of debt, spending and deficits since WWII are likely to push the political economy towards fiscal dominance until and unless there is a crisis that causes a course change for federal government finances. We expect increased monetary and fiscal policy coordination through the ‘20s; gone are the days when Fed Chair Greenspan forced President Bush to break his campaign promise; ‘read my lips, no new taxes’.