There's a New Sheriff in Town

Fiscal Dominance, Fed Policy Put, Payrolls, Earnings Recession Ending, But Revisions Turn Lower, Tactical Upgrade for Equities

Fiscal Dominance

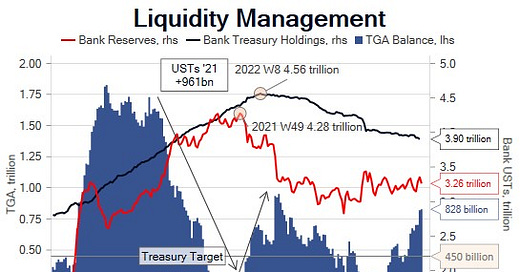

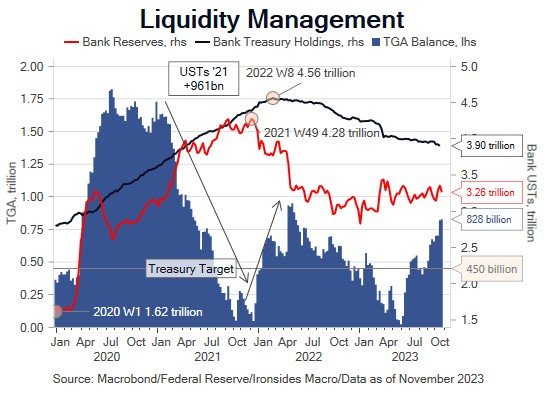

Legendary investor Stan Druckenmiller set off a storm when he criticized Treasury Secretary Yellen for debt management during the pandemic. While the financial press and FinTwit (FinX?) rushed to defend Secretary Yellen, there is no doubt that the actions of the Yellen Treasury have had a much larger impact on markets than any Treasury since the 1951 Fed/Treasury Accord. At the core of the Treasury’s recent impact on markets is the largest debt to GDP ratio since WWII, consequently, any changes in policy have any outsized effect on the most important price in the global financial system, the benchmark 10-year Treasury. To be sure, Treasury could have extended the duration of the existing stock of debt in ‘21, had they not been injecting a greater amount of liquidity into the system than the Fed in a shorter period by slashing issuance. Our regular readers will recall our detailing of the draining of the Fed’s checking account (TGA) from $1.7 trillion in February ‘21 to $50 billion in September by slashing issuance as they were sending checks to the public, states and local governments, following the passage of the $1.9 trillion stimulus. We don’t need to remind you what happened to asset prices in early ’21: meme stocks, peak crypto frenzy, and unprofitable tech, to name a just few examples. The Treasury’s decision to drain the TGA by reducing issuance was monetary policy accommodation.

As it became clear that the inflationary shock was not transitory, the Fed began a methodical process of ending accommodation. While the Fed was dragging its feet due in part to the forward guidance straitjacket, the Treasury acted more decisively. It drained $900 billion from bank reserves by increasing issuance and rebuilding their TGA balance during the first four months of 2022, before the Fed halted large-scale asset purchases (QE). The 27% S&P 500 10-month decline began prior to the first Fed hike, even as QE continued. The Fed undoubtably believes their forward guidance was the culprit, however the Treasury was responsible for the liquidity shock and in our view, the aggressive debt management was a policy decision intended to have macroeconomic effects. In other words, former Fed Chair and now Treasury Secretary Yellen knew what she was doing, and her actions had profound monetary effects.