Macro Themes for '23 and Beyond

Deglobalization, productivity, the bond bear market, revenge of the old economy

This is the second of our three annual outlook notes, and because we tackle thematic investing, it is the most intellectually challenging and interesting (from our perspective) of the notes. Last year’s note covered the following themes:

2022 Themes: Macro Themes for the '20s Cycle

‘60s or ‘70: Length of the Cycle

The End of US Equity Market Outperformance?

Power to the People

The Natural Rate of Interest

2021 Themes: Macro Themes for 2021 & Beyond

Echoes of the ‘60s

Schumpeter’s Gale: The Pandemic

Rebuilding the US Capital Stock

Deglobalization, Collectivism and Mercantilism

The End of the 39-Year Bond Bull Market

2020 Themes: Macro Trends for 2020 & Beyond

Deglobalization

Capitalism, Socialism and Mercantilism

Energy & ESG

Interest Rate Suppression

Reflecting on the last two years of our thematic outlook notes, what is clear is that pandemic restrictions, fiscal and monetary policies that initially exacerbated multi-decade trends including disinflation, unconventional monetary policy, unsustainable government debt, falling labor share of income, slow productivity growth, low real interest rates and malinvestment, were so excessive that they are serving as catalysts for major inflection points or accelerants in these trends. The note we wrote in December 2019, prior to the pandemic, identified vulnerabilities in global supply chains, export dependency, the ESG movement and underinvestment in energy and the unintended consequences of large-scale asset purchases. Because these notes are intended to identify secular trends, we will begin by offering updated thoughts on last year’s themes.

Reflections & Updated Thoughts

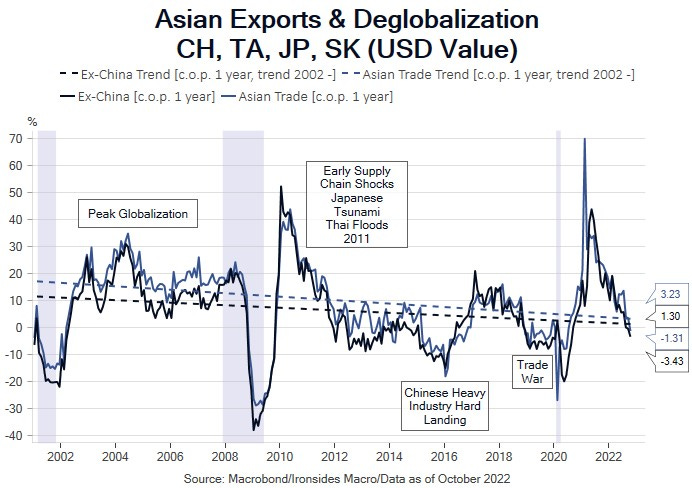

In last year’s note we began with a discussion on the length of the business cycle and our expectation that inflation would fall to 4% by 2024, allowing the cycle to extend into the mid ‘20s. Thus far, the economy has proved far more resilient to tighter monetary policy than most believed, however 2023 is the make-or-break year for this thesis. Our second theme was less about the US and had more to do with the collapse of export-dependent economic models in China, Japan, Germany and much of the developing world. Initially, as supply chains cleared, global trade growth spiked higher, however as the year winds down, global trade is contracting and the center of the globalization world, Asia, has a clearly defined downtrend that is approaching zero growth. There was an additional shock to the export dependent economic model in 2022, the combination of the energy crisis and the dollar evolving into a petrocurrency that exacerbated the crisis.