Choose Your Battles

Risk-off, the Fed picks a political fight, disinflation is likely to resume, seasonally adjusted labor data extends the pause, earnings season and Senate hearings begin

Risk-Off

Since we moved on from our three annual outlook notes; 2025 Outlook: Targeting a Trifecta (outside the paywall), 2025 Themes: The Bill Comes Due, and 2024 In Review: Quadrilemma, in our notes and appearances, we been emphatic that the clear and present danger for the equity market was the bear steepening of the Treasury market. While the reaction to Friday’s December robust employment data was Treasury curve bear flattening, due to expectations the FOMC’s pause could extend through the entire first half of ‘25, the narrative we heard from some equity centric investors that bond yields are going up for the ‘right reason’ is overly simplistic and likely wrong, at least in the near term. Equity investors became accustomed to the S&P 500 shrugging off policy rate hikes; however, this was because fiscal and Fed balance sheet policy were accommodative. Now we have significantly higher longer maturity real rates and a tighter fiscal policy outlook. Financial conditions are tightening. We’ve been asked in client discussions and media appearances why was the equity market looking through the increase in Treasury term premium and higher longer maturity real rates, our response has been that it hasn’t. What we were really being asked was, at what level of rates would the historically low S&P 500 correlation flip to a high velocity, correlation spike, risk-off, every sector down correction, and it looks like we have reached that level.

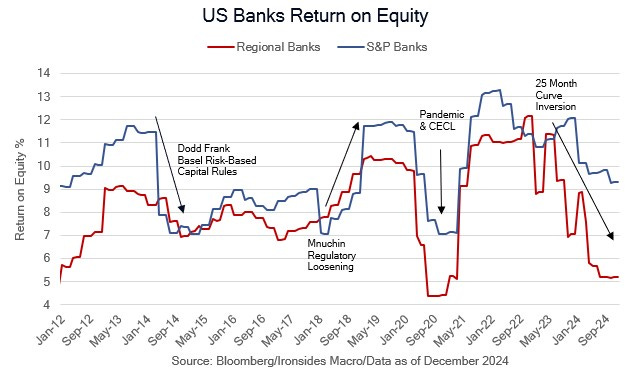

The equal-weighted S&P 500 is 8% off the late November high, the Russell 2000 small cap index is 10% off the post-election high, having retraced the entire rally post-election rally. While we increased our exposure to small caps marginally following the election, we warned that the surge in business confidence due to expectations of favorable tax and regulatory policy was a plus, but the more intractable issue was the Fed’s policy rate and poorly executed tightening cycle (aggressive hikes and passive QT) that effectively closed the bank credit channel. While the disinversion of the 3m10y banking business model proxy Treasury curve is a longer term positive for small bank profitability and credit availability, financing remains expensive for floating rate borrowers and the increase in term premium reduced the value of bank fixed rate assets. On balance, if the Fed pause does extend through 1H25, the long anticipated healthy broadening out of earnings and stock prices to economically sensitive sectors, mid and small caps, could also be postponed to 2H25 at the earliest.

Next week, Senate hearings on President-elect Trump nominees begin, we suspect all the press attention will be on national security appointments, which will allow the economic team to fly through the process. Additionally, Congress appears to be moving towards our preferred approach of including tax policy and spending cuts in the first reconciliation bill. As we’ve written, policy sequencing is crucial for turning the post-election boom in business confidence into increased investment. We remain optimistic about the policy outlook and in particular the incoming administration and GOP controlled Congress cutting spending back to a sustainable level, for now, market participants do not agree. However, earnings season begins next week, and our net revisions models are weak for a couple of key sectors (tech and industrials). The Treasury market appears to be grinding towards a retest of the October ‘23 high for nominal 10s at 5% and 10-year TIPS at 2.58%. The euro, yen and yuan are all approaching key downside levels. In short, it appears the post-election hangover has further to run. We’ve been holding a decent cash position; we are getting closer to an opportunity to put it to work, but not yet.