2024 In Review: Quadrilemma

Four 4s, Weak Labor Market Foundation, Uneven Financial Conditions, Immigration Not a Panacea, Narrow Earnings Recovery, Yield Curve Disinversion

Private Sector Productivity Boom and Policy Bust

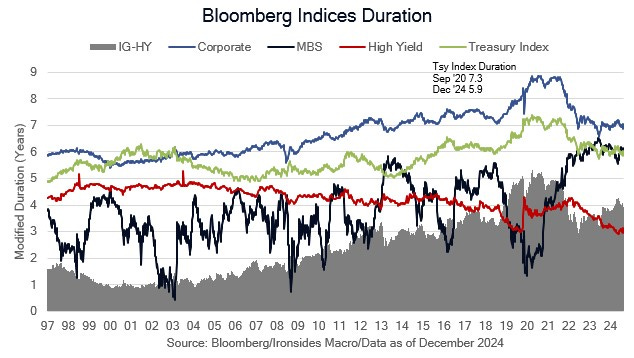

The year is ending with another wave of Treasury market bear steepening, and like the first four months of ‘24, when tightening of financial conditions in the back end of the curve left most of the equity market struggling, with the exception of technology and related sectors, the equity market is stumbling to the finish line. The dichotomy between 40% gains in the technology and communication sectors, and flat performance for the materials and energy sectors that will provide the infrastructure to build the data centers to power the generative artificial intelligence large language models, is stark. A consistent theme in our work has been the battle between the private sector productivity boom that began in the last two years of the prior business cycle, and the fallout from the pandemic excessive monetary and fiscal policy response. As a consequence of the pandemic policy panic, the path between real rate shocks and a crumbling labor market foundation, due to the pressure the Fed’s accommodative balance sheet and restrictive rate policy put on small banks and small businesses, has been narrow. For small caps, housing, industrials, energy and materials, the path was particularly narrow, during the summer growth scare they struggled, when real rates increased sharply in 1Q and 4Q, they also struggled.

We’ve been critical of passive QT and aggressive rate hikes since the FOMC started down this path in late ‘21/early ‘22 when they allowed QE to continue even as they pivoted to rate hikes. The financing of government spending 4% above its 50-year median level relative to GDP with 50% more short-term bill issuance than the Treasury Borrowing Advisory Committee (TBAC) recommends and Fed balance sheet accommodation, has not prevented longer maturity real rates from increasing. The overhang of the Fed’s portfolio and Treasury reliance on short term financing, combined with bank regulatory policy that forced basic market making out of the banking system to hedge funds in a futile effort to ‘protect’ taxpayers, has left the Treasury and equity markets vulnerable to extreme risk-off shocks like August 5th and December 18th.

In our annual year-in-review note we will discuss a series of differentiated themes; we begin with our quadrilemma, or four 4s theme. In short, we suggested early in the year the unemployment rate need to exceed 4%, and wage needed to cool to 4%, to get the Fed to cut to 4% and stabilize the 10-year Treasury in the vicinity of 4%. The Fed’s policy rate dependent tightening cycle shifted the burden primarily on small banks and businesses. The Biden Administration’s immigration policy cooled wage growth, but only for lower income workers. Prices stabilized, but at a faster than pre-pandemic inflation rate, largely due to the Fed’s tightening process impairing the supply side of the housing market and continued accommodative fiscal policy. The earnings recovery from the 4Q22 to 2Q23 modest earnings recession never broadened out, capital investment continued to slow. Despite upward revisions to GDI through 2Q24, in 3Q it was a meager 2.1% due to a deceleration in the net operating surplus of private enterprises (corporate income). On balance, the Trump economic team is adopting an unbalanced economy with a weak foundation, an excessive level of government spending and a risky debt management strategy. That said, corporate sector leverage is low, productivity growth is strong, the investment opportunities are plentiful, and business confidence bounced in the wake of the election.