The Bond Bull is Dead

Long live the bond bear, negative term premiums, a deep dive into the market message, housing, the manufacturing renaissance, China reopening

The Bond Bull is Dead, Long Live the Bear

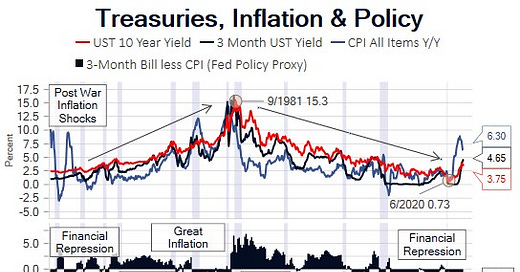

The Treasury market approached another milestone this week in what we expect to be the second secular bond bear market since WWII, as 2s approached 5% for the first time since the Global Financial Crisis. The markets and our outlook are in something of an eye of the storm: the cyclical trend for 2023 is disinflationary, however the secular trend for the ‘20s, is inflationary. If a soft landing implies resilient growth and a return to the Fed’s 2% inflation target, our work implies a low probability of that outcome. That said, resilient growth combined with disinflation as inflation cools from the 2022 9% peak to our longer-run trend forecast of 3-4%, is a favorable environment for equities and credit, but not so much for USTs, like the ‘60s. In August 2020 when 10-year Treasuries approached 0.5% we first made our call, discussed in detail in our macro themes year-end note, Macro Themes for 2021 & Beyond, that the 39-year bond bull market that began when we were working on our undergrad degree in economics, was over. We don’t make regime shift calls frequently, but in this case we became convinced — well before the pandemic — that the primary disinflationary force, Chinese and former Soviet Bloc labor force integration into global supply chains, was no longer exerting pressure on goods prices. With two decades of stable core goods prices (-0.1% average from 2002-2019), trend inflation would be closer to trend services and housing inflation just below 3% at a minimum. Meanwhile, this exogenous force had led to overly accommodative monetary policy that misallocated capital, thereby impairing real capital formation and enabling fiscal policy profligacy. The pandemic policy response accelerated the shift to a higher inflation, rates and nominal growth regime. There is no turning back. globalization is in reverse, and fiscal policy is following the ‘60s and ‘70s path that was the primary cause of the Great Inflation we detailed in our February 11 note, Inflation Mythology.