Ripping off the Band-Aid

Strategic Policy Put, Tactically Short, Restructuring QT, Setback for Team Transitory, Curious Bull Steepening

Return of the Fed Put?

In last week’s Quadrilemma, we argued that it is an oversimplification to point out the spread between market expectations for the YE24 policy rate and the FOMC Summary of Expectations, and we detailed that labor market conditions that would be required to accelerate the cutting cycle. Meanwhile, we spent the early part of this week discussing the outlook for QT, which we will refer to as the Logan/Williams debate. To cut to the chase, our view is that the October Treasury Quarterly Refunding Announcement, that they were going to exceed the Treasury Borrowing Advisory Committee’s bill issuance 15-20% guideline, was a band-aid that could force an early end to QT.

We will discuss the Logan/Williams debate, the outlook for QT, and for the Fed’s balance sheet in greater depth later in the note, however before we go there, we wanted to reconcile our tactically bearish outlook with our more optimistic strategic forecast by considering the implications of the Fed’s bias to ease. In short, the end of the rate hike cycle and higher probability of aggressive policy easing, rather than a resumption of the hikes, limits downside risk to both Treasuries and equities. However, Thursday’s stalling disinflation CPI report increases our confidence in our bearish tactical outlook detailed in last week’s note.

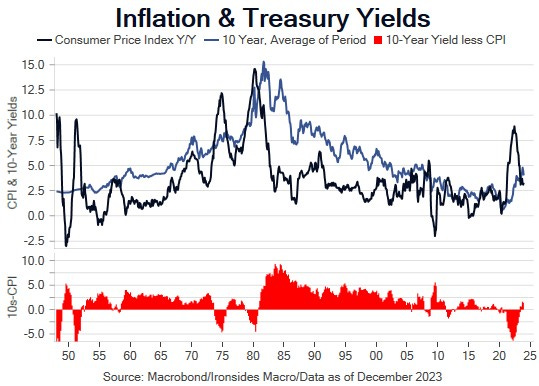

When we wrote our 2024 Outlook: Put, Pause, Pivot, the FOMC had not confirmed the end to the rate hike cycle, nor had they reduced their YE24 policy rate forecast well below 5%. The minutes of the December FOMC made it clear the employment/inflation tradeoff embedded in the 1978 Full Employment and Balanced Growth Act remains the prevailing modus operandi, implying unequivocal evidence of additional labor market slack was the sufficient condition for more rate cuts than the December SEP forecasts. However, the near-certain end of the rate hike cycle and change in the bias to ease that was evident in the SEP, and Chair Powell’s press conference that triggered the ‘pivot party’ risk-on rally in equities and USTs, was not ‘walked back’ by the minutes or by the multitude of FOMC participant speeches since the December meeting. This ‘skew’ in the range of economic outcomes points a greater probability of aggressive rate cuts than additional hikes. Thursday’s December CPI report was consistent with our outlook that the pace of disinflation will slow and will remain above the FOMC’s target, but it is unlikely to turn higher and restart the hiking cycle. Labor demand is weakening, and while there is no evidence at present that supply exceeds demand as evidenced by low weekly initial jobless claims and a 1% layoff & discharges rate, the probability of the FOMC getting concerned about missing on their employment mandate is greater than inflation turning higher during 1H24.

The change in the policy bias reduces the probability of either a sharp correction in equities related to slowing growth back to the October S&P 500 low or a renewal of the August to October high velocity bear steepening. In other words, the spread of market expectations relative to the SEP, probability weighted, is marginally smaller than the 6 vs 3 linear extrapolation implies. The policy easing skew (in derivative terms, a fatter easing tail) is a form of a policy put that is integral to our reasonably optimistic full year 2024 outlook. However, the quadrilemma of a 4% policy rate, 10-year Treasury yield, 4% unemployment and 4% wage growth that disinverts the curve without a growth scare that leads to a moderate equity market correction, is improbable and remains our core tactical view. Consequently, we are holding a decent amount cash, underweight financials and small caps, market weight technology and related sectors, overweight industrials and energy due to secular rather than cyclical factors, and underweight defensives and modestly short duration. Not an exceptionally bearish portfolio, but not aggressive either.

The sharp rally in 2-year Treasuries following an unfriendly CPI report on Thursday, was turbocharged by a soft PPI print on Friday, due to components from both reports that suggested the Fed’s preferred core personal consumption deflator would be cooler than CPI. The rally in 2s has the benchmark 2s10s curve within striking distance of disinversion at -22bp, 86bp steeper than the early July low at -1.08%. At the risk of sounding flippant, it appears the favorite fixed income 2024 trade is a steepener and traders are determined to press the bet whether the data and Fed communication is supportive, or not.