Four Fours: U3, AHE, 10s & Fed Funds

Noting that the 75bp spread between the December Summary of Expectations and the market implied policy rate for year-end ‘24 and 75% probability of the first hike in March is inconsistent with FOMC participant guidance is obvious, but incomplete. The baseline equity market participant reaction is to simplify the outlook by concluding the hiking cycle is done, which it clearly is. Consequently, it is time to increase cyclical exposure, particularly given the earnings recovery from the 4Q22-2Q23 shallow earnings recession. For those steering a battleship, or in this case a large pool of capital, this outlook is reasonable and consistent with our full year 2024 outlook. For those looking for a more optimal entry point to add equity market exposure, add cyclical sector exposure (also known as ‘healthy broadening out’ in financial media), or extend fixed income duration, it requires a deeper dive into the intersection of the market implied policy path, earnings expectations and the Fed’s reaction function.

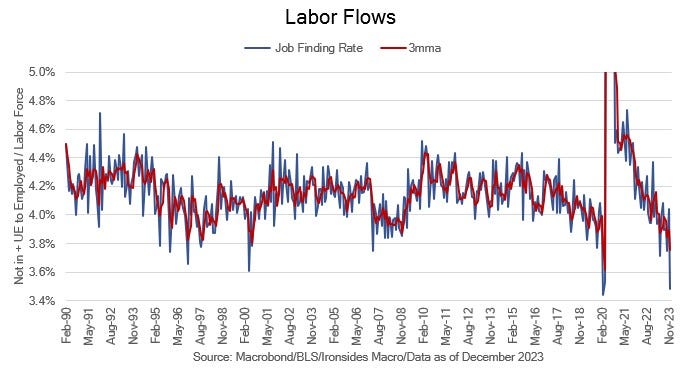

So, we begin with an eye on next Thursday’s December CPI report, last week’s labor market data and the minutes of the December FOMC Minutes that confirmed the end of the hiking cycle, but left open the timing and magnitude of the pivot. We will dig into the tactical outlook in this week’s note as we move on from our annual outlook notes, and shift back to the session-by-session battle. The bottom line is this: without an unemployment rate above 4% and nonsupervisory average hourly earnings sustainably below 4%, 10-year nominal Treasuries are unlikely to remain below 4% and the Fed is unlikely to reduce the policy rate to 4%, the level that will disinvert the yield curve and reopen the bank credit channel thereby facilitating the ‘heathy broadening out’. If additional labor market slack does start the FOMC down an aggressive rate cut path, the probability of a ‘V’ shaped earnings recovery needs to be marked down. If that occurs, the ‘healthy broadening out’ is likely to take a Guiseppe Fibonacci retracement (at least a 38.2% back to 4535) back below the December FOMC pivot party lift off point. Our quadrilemma is reaching all of these 4s, without a growth scare, that causes an earnings expectation downgrade, seems highly improbable. Like the old proverb, it looks like you can’t get there from here.