Under Promising

Pre-pandemic inflation trends on steroids, FOMC preview, No debating excessive spending, Party like it's 1995 but not you banks

Note: We will be in Boston on Monday and Tuesday, followed by NYC on Wednesday through Friday. We have a couple of open slots, please email bcknapp@ironsidesmacro.com if you’d like to meet.

Costanza Banking Rules

One of the most interesting, but least discussed, developments last week was the partial re-proposal of the Fed, FDIC and OCC bank capital rules. In response to the Silicon Valley Bank collapse that was primarily attributable to the Fed’s excessive ‘20 and ‘21 easing and their politically motivated decision to end the suspension of the Supplementary Leverage Requirement (SLR) that funneled deposits to banks that had no idea how to manage interest rate risk, Biden Administration appointees decided to go all in on Warrenomics and increase the already overcapitalized banking sector capital requirements. Financial media and investors not familiar with the performance of the sector in periods of excessive regulatory policy, namely the ‘50s and ‘10s, seemed puzzled by the negative stock price reaction. With return on equity below 10%, even for banks partially immune to the deeply inverted yield curve due to fee income and capital markets activities, any additional capital will degrade profitability further below the cost of equity capital. Like the ‘50s and ‘10s, this is likely to led to weak credit creation and low nominal growth. It strikes us that rather than following Europe’s lead and adopting Basel End Game rules (BG3), US regulators should be applying the Costanza Rule and doing exactly the opposite of what European regulators suggest. Make no mistake, this is the sector with the most at stake in November.

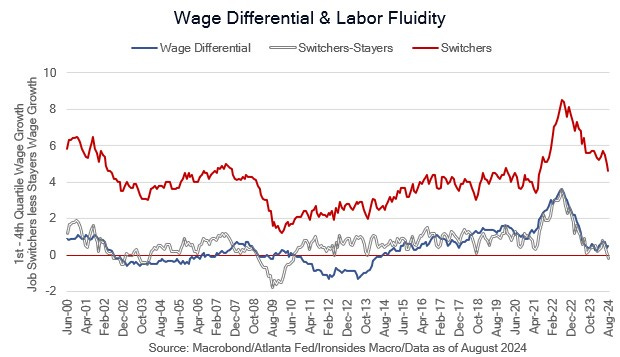

This week’s sharp rebound in the equity market during inflation week put the market back in the same mode as was the case for the first seven months of ‘24, a tech driven rally. We remain convinced that the only path to the ‘healthy broadening out’ of the rally runs through a sustainable disinversion, in other words the Fed needs to over deliver, a tall task with easing expectations at the beginning of a cutting cycle never as aggressively priced as is the case today. Aggressive easing requires weak growth, as we will discuss later in the note, there were elements of the August CPI report that suggest disinflation, as was the case in 2H23, is overly dependent on goods deflation. In other words, for the Fed to not under deliver, the employment mandate is the most likely catalyst. We expect weaker demand for labor to become increasingly evident in consumption data, Tuesday’s August retail sales report is the next important data point, and despite the 93bp decline in the Bankrate.com 30-year fixed rate mortgage index, housing construction is likely to struggle as well. Meanwhile, analyst estimate revisions continue to fall for the consumer discretionary, staples, energy, industrial and technology sectors, dragging the S&P 500 year-end estimate lower. Next quarter expectations are for a mid-single digit increase, ex-tech & communication services earnings are only expected to increase low single digits. However, Lipper Refinitiv Analytics has expectations for earnings growth accelerating to 13.4% in 4Q and 15% in ‘25. In our view, the only plausible near-term path to further gains in the S&P 500 is a resumption of the tech led rally, the broadening out is a low probability outcome.

Ahead of our trip to Boston and New York next week, we’ve written a dense note that begins with a review of inflation week, moves on to a preview of the FOMC meeting, delves into the political economic outlook for taxes, spending, debt and deficits, despite the absence of any discussion during Tuesday’s debate. We finish with thoughts on the ‘95 analog when the Fed escaped a hard landing during the early stages of a technology investment boom, focusing on the different environment for the banking sector and add some thoughts on homebuilders, the energy sector and Treasury market.