Turning the Page

Meet the New Boss(es), Inflation Convergence, Cooling Wage Growth for Joe Six Pack, Secular and Policy Consumption Tailwinds, Treasury Supply Challenges Remain

Turning the Page

The markets price action last week was a combination of election week, and the week Scott Bessent was nominated for Treasury secretary. As we discussed in our first note of 2025, Beware January Reversals, the first month of the year can be brutal for investors leaning too heavily into their favorite trade for the new year. This week we got a nasty January reversal of the retest of 5% 10-year USTs that carried out shorts on a benign, but not significantly cooler than expected, CPI report and Scott Bessent, a much steadier hand on the Treasury issuance rudder, sailing through his senate confirmation hearing. When all was said and done, equities had their best week since the election and Treasuries had their best week since Bessent was nominated. As we will discuss this week, the CPI report was in line with our expectation that the Fed’s balance of inflation risk tilted to the upside is misplaced, but the primary driver of higher rates was, and continues to be, the excessive supply resulting from the profligate Biden Administration and 117th Congress. The challenges awaiting Trump’s strong economic team of Bessent, Hassett and Miran are formidable, and we suspect 5% 10s are still highly probable before the passage of a reconciliation tax and spending bill, most likely in May.

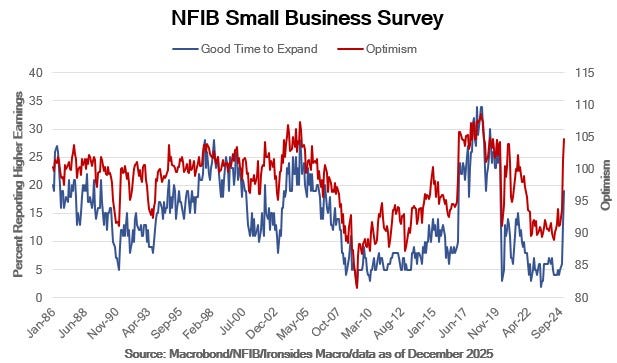

The main focus of the domestic economic data this week was inflation, however, we also received three business confidence surveys, the December NFIB Small Business, and January Empire State and Philly Fed Manufacturing Surveys. In all cases the post-election business confidence positive shock improved further. We listened to two Senate hearings this week, the department of energy and treasury, we don’t recall ever listening to any hearings other than Fed Chair appearances. Both of these appointees are strong candidates in sectors that are crucial to the economic well-being of the nation.

The broad-based rally in equities led by energy, materials and financials, three of our favorite sectors, was justified by the confidence these candidates projected. The energy hearing was particularly interesting, other than one partisan attempt at social media gotcha, our read of the questioning from the opposition party was a genuine interest in various sources of energy beyond the typical solar and wind talking green energy bluster. We remain very overweight the energy sector.

In this week’s note we will review inflation, wage growth, consumer spending, the outlook for the financial sector and wrap up the note with the Treasury and equity market implications.