Beware January Reversals

Higher term premium, Business confidence bounce, China's liquidity trap, QT update, Beware January reversals

Treasuries Overvalued

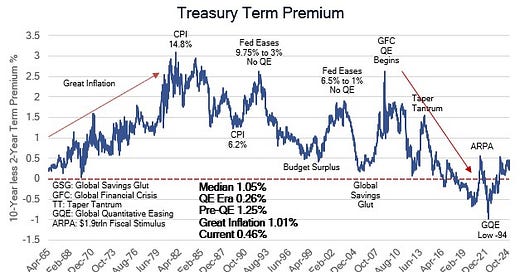

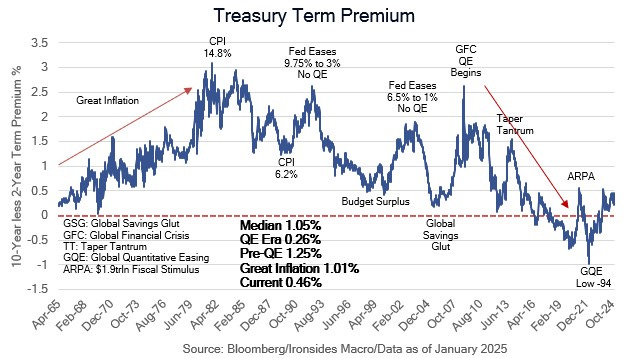

On New Years Eve, Apollo’s chief economist Torsten Slok in his widely followed Daily Spark, noted that the term premium of 10-year Treasuries increased 75bp over the last 3 months. Dr. Slok characterized the increase as follows: “10-year rates have increased an additional 75 bps more than what can be justified by changing Fed expectations, which is likely a reflection of emerging fears in markets about US fiscal sustainability.” From our perspective, the 75bp increase only retraced half of the rate suppression attributable to the Fed’s holdings and the Treasury Department’s reliance of bill issuance (Activist Treasury Issuance/ATI) as measured by the pre-QE era median level. We prefer to monitor the term premium 2s10s curve to further isolate the risk premium from monetary policy expectations. In short, the pre-QE era median level of the 10-year term premium was 1.89%, today it is 0.49%, for the 2s10s curve the pre-QE median was 1.25%, now it is 0.46%. Since the Fed began large-scale asset purchases in late 2008, the median 10-year term premium is -1bp and 26bp for the 2s10s curve. Prior to the QE era, the term premium of 10s or the 2s10s curve only approached zero twice, in late ‘69 prior to the end of the ‘60s expansion and during the global savings glut in early ‘06 prior to the Japanese unwinding BOJ QE1 in 2Q06. A negative term premium makes little sense, and the only plausible explanation is policy intervention. Further supporting our thesis that QE is suppressing term premium is the spike to 2.5% in the early ‘90s when the Fed eased aggressively without QE and again in the early ‘00s following budget surpluses that drove term premium below 0.5% in the late ‘90s.

We began our first note of the year with this modestly esoteric valuation discussion to underscore the largest global risk for early 2025, tighter financial conditions due to a further increase in inflation-adjusted longer maturity rates (TIPS yields). In our 2025 thematic note The Bill Comes Due, we discussed the overhang of Fed holdings, risky Treasury debt management and the deficit outlook. The incoming economic team is well qualified to deal with these issues, however there are no easy solutions and as we discussed earlier, the risk premium remains historically low. From a cyclical perspective, notwithstanding seasonal adjustment factors corrupted by the pandemic policy panic that are likely to boost January employment and inflation data, cooler housing services inflation and weak demand for labor from small businesses should help to stabilize the Treasury market and put the Fed back into easing mode. In short, increasing evidence the economy and inflation are growing only modestly as evidenced by 3Q24 GDI at 2.1%, Beige Book commentary and tepid earnings growth for the S&P 500 ex-technology and communication services, mid and small caps, should cap the increase in rates. Of course, this outlook is subject to government data capturing trends they struggle to measure and may not be apparent until well into 1Q25.

In the meantime, we expect additional pressure on rates as traders reset short positions after elevated year-end financing rates appeared to trigger some short covering during the last few trading sessions of ‘24. Next week’s auctions of 3s, 10s and 30s loom large. Recall the 5-year Treasury Inflation Protected Security auction following the December FOMC meeting had a 7bp tail, making it one of the weakest auctions in two decades. In this week’s note we will discuss the bounce in post-election business confidence bounce, weak demand for labor, China’s liquidity trap, outlook for QT and risk of some nasty countertrend moves in tech stocks, Treasuries and exchange rates this month.