Transition Time

Falling inflation volatility morphs into increasing economic vol, political tail risk skews negatively, Jackson Hole preview, back to the low correlation tech led rally, for now

Mr. VIX’s Wild Ride

When we turned on CNBC on Thursday morning before the 8:30 Eastern data deluge, we heard Gary Vaynerchuk, a ‘social media messaging expert’, say optimism is hard, while negativity is easy and lazy. It got us longing for the days during the depths of the pandemic policy panic when we were optimistic that the dynamic small business sector would overcome the pandemic policy overreaction, and equities would rally in response. More recently, in our 2023 outlook note, 2023 Outlook: 9 to 4, but then what, we were optimistic that the peak of the inflation shock and monetary policy response were over, and the markets would retrace the 27% 2022 earnings recession related decline. We’ve written frequently about the battle of the productivity boom overcoming the policy bust, in short, our outlook is for a strong capital spending cycle like the ‘60s or ‘90s enhanced by accelerated technology innovation adoption diffusing across a range of sectors, notably healthcare. This secular trend in turn would overcome excessive government spending and deficits as well as Fed intervention into a part of the market they have no business being involved in, namely the setting of longer-term rates.

Currently, in the near-term, we find ourselves biased towards Mr. Vaynerchuk’s negativity, but don’t view it as lazy. Instead, we struggle to overcome our bias towards the spontaneous economic order solving problems, creating wealth and an improved standard of living, while government interventions to stabilize ‘market failings’, mostly makes things worse. Before the US data deluge, we reviewed the second largest economy’s (China) monthly data dump. The clear message was that increasing government control over the means of production is failing. Private sector fixed asset investment year to date growth of zero relative to 6.3% growth at state-owned enterprises while the aggregate level slows, industrial production at 5.1% while retail sales increased 2.7%, amidst collapsing real estate investment and falling house prices as the government directed housing bubble bursts, are all examples of failing industrial policy. With such a stark example of falling industrial policy, as well as Japan’s three-decade struggle to overcome their malinvestment bubble, we can’t help but view US economic and inflation data and see the deleterious effects of the Fed’s ill-advised intervention into the price of the discount rate for long-term capital investment, as well as the largest non-recessionary deficits and government spending and the inevitable degradation of productivity growth due to industrial policy malinvestment. We will come back to this topic in our discussion of this week’s data and the implications for markets.

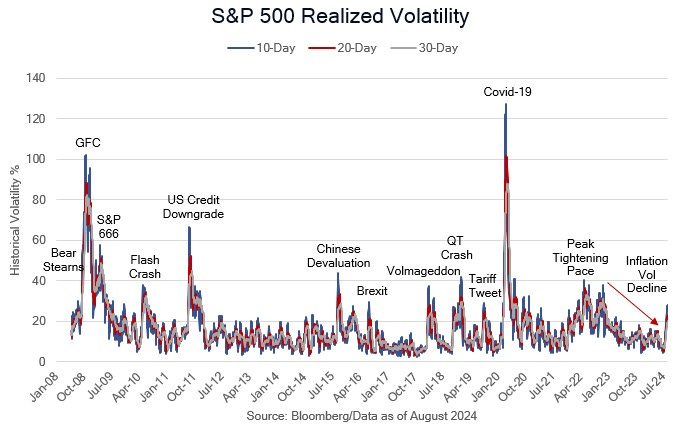

Perhaps the most interesting question we received this week was about the wild ride in equity index implied volatility. Recall our thesis that the decline in both realized and option implied volatility for equities and fixed income from October ‘23 through July ‘24 was largely a function of falling inflation volatility as the standard deviation of all items CPI plunged from a 3Q23 average of 1.74%, to a 2Q24 average of .25%, against the median in CPI’s history since 1947 of 0.58%. The periods of persistent low inflation volatility, our definition of price stability, in the early ‘60s and late ‘90s, had the most robust post-WWII capital investment cycles and had high equity market valuation and earnings growth. So how do we explain the spike in the VIX to 60% and back to the 15%, the deep inversion of the VIX futures curve, and the explosion of the VVIX? Our answer is that we are transitioning from falling inflation volatility to increasing economic volatility, and negative labor market convexity in particular, and the Monday spike in the VIX was not a one-off, it was a warning shot of a regime change from disinflation to slowing growth. There is a complex back story here: a strategy known as dispersion trading, buying individual equity option volatility in the largest index components (often the top 50) and selling index option volatility, suffered large losses as the growth scare caused a volatility spike in the smaller economically sensitive index components that these strategies were implicitly short. The losses accelerated following July payrolls, leading to liquidation (margin calls) of a range of speculative positions. The strategy was working in the tech led, low implied correlation equity rally, but when the labor market cracked the regime change caused large losses. As we explained in last week’s note, the rally in the yen was also triggered by the markets discounting overly restrictive monetary policy due following cooler inflation and weaker growth reports. These were not random events; they are warning signs.

In this week’s note we will review the inflation and economic data in detail, mark the monetary policy outlook to market ahead of the Jackson Hole Economic Policy Symposium next week, offer our thoughts on the evolving political policy outlook and update our sector and asset allocation views.