The Trump Treasuries Trade

First Arrow Skepticism, Rents Cooling, The Price Theory of Labor, The Reason to Keep Cutting

Business as Usual

During our trip to NYC and Boston the consensus budget outlook was best characterized as business as usual. Expectations for Treasury Secretary nominee’s first arrow, a 3% budget deficit, are low. Even before inauguration day, policy analysts have been telling investors a 4-year extension of Tax Cuts & Jobs Act provisions and tax rates, combined with some additional campaign cuts is the most likely outcome. Few expect spending to return to 20% of GDP, the standard response is the GOP controlled Congress and Administration will not touch entitlements, consequently, given rising interest costs and the need for additional defense spending, discretionary spending is too small to achieve the 3% deficit goal. One of the key constraints sited by investors is the narrow House majority. As we discussed in last week’s note, 2025 Outlook: Targeting a Trifecta, we are more optimistic that spending can be returned to 20% of GDP and tax provisions can be made permanent. We noted in our discussions this will be the first time a second term president controlled both houses of Congress since FDR. Additionally. if there is an issue all Republicans agree on, it is cutting taxes and spending.

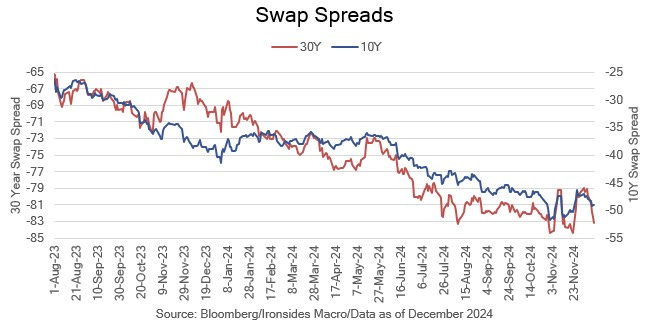

NYC investor cynicism about DC is far from surprising and was evident in the bear steepening of the Treasury curve with 10s back to a key 4.3% key technical level, 30s back above 4.5% and 10 & 30-year swap spreads reversing the Bessent nomination tightening despite strong 3& 10 auctions this week, the 30-year auction was sloppy, underscoring the deteriorating supply outlook. The bear steepening was primarily attributable to real rates (TIPS yields), suggesting the move was driven by the outlook for supply, rather than inflation. This was inflation week, and while core CPI increased 0.3% for the 4th straight month, and PPI was hotter than expected, cooler rent of shelter, non-housing services and the PPI components that feed into the personal consumption deflator imply a 0.1-0.2% reading. Investors were short duration (longer maturity USTs) going into the election, were surprised by the short covering and rally in 10s from 4.5% to 4.15% but appear to be reloading their short positions.

In this week’s note we review inflation week and some fresh information you most likely missed that strengthens our view the labor market is considerably weaker than the payroll data suggests. We also preview the December FOMC meeting and make our case for easing.