The Path of Least Resistance

Decent Auctions, CBO Budget Update, Long & Variable Lags, CPI Preview, Still Bearish USTs

Policy Tweaks, Payrolls & Treasury Supply

April ISM manufacturing and services surveys slipping back below 50 and a weaker than expected April employment report, created a favorable environment for the 3-year auction on Tuesday, the part of the curve we are overweight. By Wednesday, the outlook began to shift for a dubious reason: the Atlanta Fed 2Q24 GDP Now 4.2% tracking estimate, based on a strong end to 1Q but very little actual 2Q data. We have long urged caution on these models until much later in the quarter, and it never ceases to amaze us how the vast majority of individuals who appear on financial television and who cite GDP Now to support their outlook clearly didn’t bother to go on the Atlanta Fed website and open the spreadsheet before mentioning it. That said, buyers of the 10-year auction were losing money until another (likely quirky) data point, weekly jobless claims, which jumped due a spike in NY initial claims, improved the tone ahead of the 30-year auction.

On balance, the reduction in QT, the firming of the easing bias despite the unfriendly 1Q inflation data, Treasury’s buyback program to improve liquidity, and most importantly, a softer April employment report, all served to increase investor demand for long duration and the auctions cleared without a significant price concession. The post-FOMC meeting speeches and media appearances were broadly consistent with Chair Powell’s press conference and did not alter the market implied policy path. The committee’s Comfort with the Curves normalization of the relationships between vacancies, wages and unemployment (Beveridge and Phillips Curves) has shifted the Fed’s singular focus on inflation in ‘22 and ‘23 to a much larger weighting in their reaction function for the labor market in ‘24. A point we may not make enough is the current level of benchmark 10-year nominal and real rates, 4.5% and 2.15%, are not sufficiently restrictive to impair either the capital spending boom we expect to persist through this business cycle or positive equity market returns. This week’s price action was a microcosm of the higher inflation regime, equities are higher but buyers of the 10-year auction lost money.

While the April employment report opened the door a crack to a summer rate cut, we still think there is a strong possibility of a risk-off episode due to 10s retesting the October 5% high as the market struggles to absorb growing supply. At the least, we think this is more probable than the Fed initiating a cutting cycle that results in a painless disinversion of the 3m10y banking business model yield curve during 2Q, and perhaps 3Q as well. In an inflationary regime, like the ‘60s, exacerbated by an unwind of financial repression (rate caps then, QE now), rate shocks are more likely to cause equity market corrections than the early ‘10s growth scare corrections.

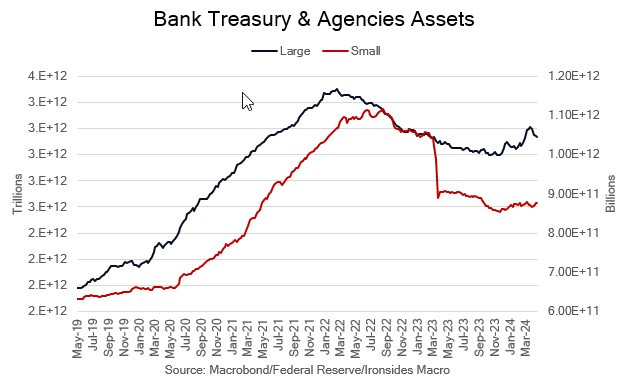

Next week is inflation week, but additionally we get the first of the regional Fed manufacturing surveys, April housing starts and permits and the NFIB small business confidence survey. In this week’s note we will discuss the CBO’s assessment of the fiscal outlook following the crucial April receipts, look at long and variable monetary policy lags in terms of bank credit with some thoughts about European and Japanese banks, preview the inflation and growth data, and wrap up the note with our latest thoughts on sector and asset allocation.