Comfort with the Curves

QRA, QT, Beveridge and Phillips Curves, Bear Steepening, Quadrilemma or Immaculate Disinflation Scenario Analysis

Monday at Noon Eastern we will be a guest on Barron’s Live weekly subscriber webcast

Tuesday at 1 pm eastern we will be a guest on CNBC’s The Exchange with Kelly Evans

Comfort with the Curves

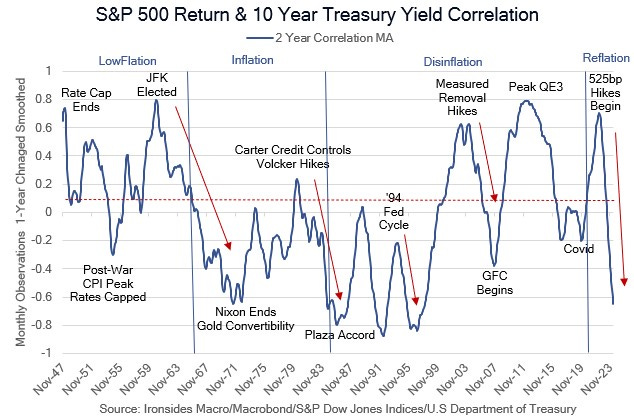

The important policy events this week — the Department of Treasury’s financing requirements and Quarterly Refunding Announcement (QRA), and the FOMC meeting — contained no big surprises, leaving the markets incrementally more dependent on cooler inflation and softer labor market conditions. Chair Powell’s press conference and the slightly larger reduction in the monthly cap on Treasury redemptions (QT) provided some comfort for investors that the Committee’s bias to ease remains intact. However, in our view slowing QT and a bias to ease raise questions about the health of the banking system and ability for Treasury to sell an additional $500bn of notes and bonds in the coming quarters without a significant price concession (higher rates). Treasury’s financing needs are marginally greater than expected and they do not plan to reduce issuance by draining their checking account (TGA) as some expected, but they continue to issue a greater amount of bills than the advisory committee (TBAC) recommends. On balance, we did not view the QRA or FOMC meeting as relieving the pressure on longer maturity Treasury rates. The federal government is running 7% budget deficits, following deficits twice that size in ‘20 and ‘21. As a consequence of fiscal spending increasing aggregate demand beyond the ability of supply to absorb the spending, inflation is likely to continue to run above the Fed’s target. The Fed and Treasury were in no position to repeat their actions of late last October, when Treasury increased bills at the expense of notes and bonds and the FOMC paused and changed their bias to ease due to goods deflation.

What did relieve pressure on the Treasury market (and will likely help the Department of Treasury auction $58 billion of 3-year notes, $42 billion of 10s and $25 billion of 30s next week), was further evidence that the labor market is moving into balance. All of the important headline numbers were market friendly: headline payrolls, average hourly earnings, and the work week were softer than expected, and the unemployment rate ticked up 0.1% though that was primarily due to rounding (3.865% vs 3.829%). As we dug into details, the picture painted by the headlines didn’t change much: the household survey was soft (25,000), job gains are coming from non-cyclical sectors, the dubious birth/death model added 363,000 jobs, the job finding rate eased, and — crucially for Chair Powell’s non-housing services inflation model — nonsupervisory service providing average hourly earnings are cooling rapidly.

The April employment report is likely to increase market confidence that the committee's bias to ease, assuming it is confirmed in the coming speech barrage, is warranted. In our view, the FOMC is more than willing to cut, even in the absence of further progress on inflation, if the labor market weakens further. Consider the Phillips Curve: from January '22 to January '23, nonsupervisory average hourly earnings cooled from 7.0% to 5.2%, despite the unemployment rate falling from 3.6% to 3.4%. In essence the curve went vertical as supply caught up to demand. Since January '23, average hourly earnings cooled to 4% while the unemployment rate increased to 3.9%. The normalization of the relationship between wages and unemployment will reassure the Fed their policy is sufficiently restrictive. Our quadrilemma thesis, where unemployment above 4% and wage growth below 4%, will trigger a rate cut cycle to 4%, the level that will painlessly disinvert the curve (keeping a 4 handle on 10s), is back in play for the July 31 meeting, if the next two reports breach our hurdles.

Perhaps counterintuitively given our inflation outlook, our view is that the Fed will begin an easing cycle with a final destination of 4% in 3Q24, but the Fed is likely to be easing because they have to, not because they can. In this week’s report we dig into the details of the QRA, change to QT, bank profitability and capital outlook, employment report and finish with equity market earnings, valuation and sector outlook.