Supply Destruction

Banking system r*, macro prudential policy flaws, Powell's wake, supply destruction

The Banking System r*

BULLARD: MACROPRUDENTIAL POLICY CAN CONTAIN FINANCIAL STRESS

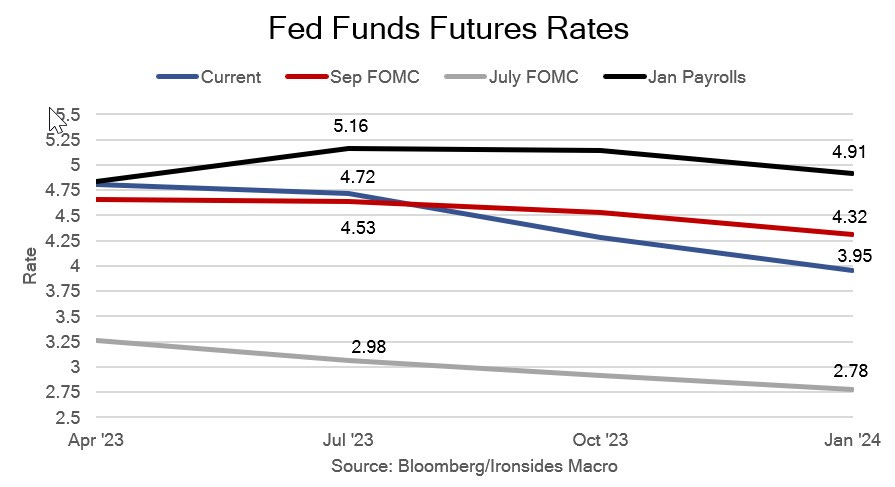

Ahead of the FOMC decision we heard a lot of chatter that the Fed would likely meet market expectations for a 25bp hike, and the market reaction would be muted. We vehemently disagreed with this superficial assessment due to the shape of the fed funds futures curve; sure, the market was discounting a 25bp hike at the March meeting, but it was also expecting a series of rate cuts in subsequent meetings. In other words, the market was confident the Fed was headed directly at an iceberg and was determined to crash into it. Some were quick to give at least partial attribution for the plunge in equities, front-end rates and the dollar relative to the yen and euro, to Treasury Secretary Yellen’s waffling on blanket deposit insurance. We have deep concerns about the implicit uninsured depositor approach. The Fed, Treasury and FDIC can declare a bank systemically important on a case-by-case basis, but what if political pressures build to teach reckless bankers a lesson, like Lehman, or the bank’s business model is financing an unfavored sector, like energy, or crypto?

As a former Lehman Brothers managing director, we lived that risk firsthand. The arbitrary application of bankruptcy under exigent legal provisions culminated in the auto bailouts. When union healthcare creditors were favored over bond holders, it was the final straw that made the financial sector uninvestable until the stress tests in March 2009 led the government to backstop the credit of the top 19 financial companies. The Swiss government’s decision to offer a modest recovery to equity holders in the arranged merger of CS and UBS and no value to the AT1 CoCo ‘bail-in’ debt, while technically legal due to the bond covenants, was reminiscent of the GSEs, AIG, Washington Mutual and GM during the GFC. Consequently, in our view, only an act of Congress can stabilize bank liabilities through an expansion of deposit insurance. That was the intention of Dodd Frank, and the risk cannot be mitigated by assurances from policymakers due to political constraints. This is a core theme of Hayek’s rule of law writings; discretion in the hands of policymakers will lead to bad outcomes. We remain convinced that trying to resolve unstable bank liabilities utilizing macro prudential policy is an exercise that is cost prohibitive when both explicit and implicit costs are accounted for. In its current state, the tail risks of additional instability remain acute. The good news is that monetary policy created the instability, and monetary policy can and should fix it, the Fed just doesn’t realize that, yet. Said differently, if the Fed meets current policy rate expectations, the problem will go away. As we discussed in Inflation Mythology, the costs of reducing fiscally driven inflation with monetary policy are prohibitive.