Real, Not Nominal, Recessions

Markets solving problems, real, not nominal, recessions, indexation chaos

The Spontaneous Economic Order

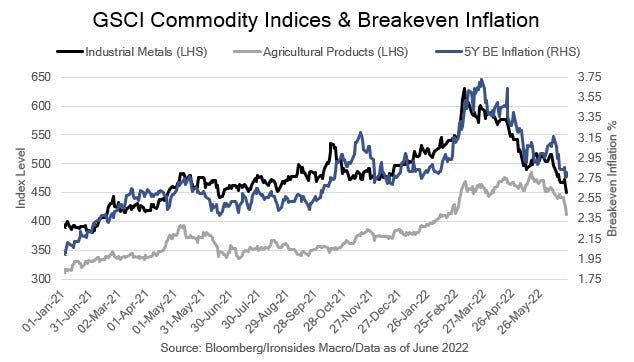

In our note earlier last week, Markets Fix Problems Policymakers Create, we postulated that the adage the cure for high prices is high prices, was a simplified version of Hayek’s spontaneous economic order and markets were likely to make a larger contribution to solving the inflation problem than the Federal Reserve. The dire forecasts from Keynesian economists Summers, Dudley and Furman are rooted in a deep belief that markets are inherently unstable and can only be stabilized by governments. Score one for classic economic liberalism this week as plunging commodity prices eased the pressure on the front end of the rates market setting the stage for a relief rally in equities. The FOMC may have had a minor victory this week as well when the final University of Michigan 5-10 year inflation survey was revised lower from 3.3% to 3.1% following the 75bp rate hike. Recession fears mounted following a brief research note from a Fed staffer that we examine in this week’s note, and those concerns contributed to the drop in commodity prices and bond yields. There is no change in our outlook that a recession is unlikely, the monetary policy setting is far from restrictive both in terms of the current and expected policy rate path in large part due to the Fed’s passive approach to reducing their balance sheet’s downward pressure on longer term rates. That said, this week’s note focuses on the implications for earnings from inflation related recessions that are typically characterized by falling real growth while nominal GDP continues to rise. We suspect that investor expectations are biased overly negatively by the three recessions prior to the pandemic, when commercial real estate, telecom and technology, then residential real estate investment booms fueled by bank credit collapsed, leading to the three largest post-WWII recession driven earnings declines.