Markets Fix Problems Policymakers Create

Central banks inflation illusions, disorderly unconventional policy unwinds, inflationary recessions and earnings

We will return to our normal publishing schedule on Saturday. After a couple of days off, here are our updated thoughts.

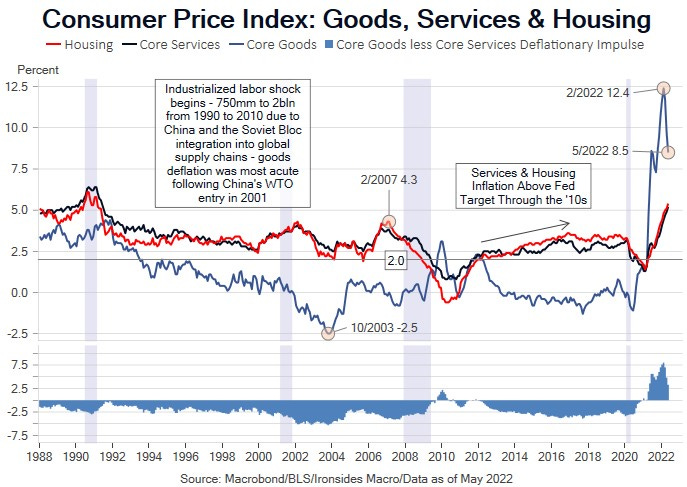

Central Banks Illusion of Control

Just prior to the pandemic panic in February 2020, we attended at small group dinner lead by a former Fed research staffer who asserted the prior three decades of disinflation referred to by the Fed, their Keynesian disciples on the street and in academia as the Great Moderation, was attributable to Paul Volcker and the resultant inflation fighting credibility. We asked about Alfred Kahn (The Father of Airline Deregulation), supply side economics and Reagan’s deregulatory policy, Chinese integration into global supply chains, the technology investment boom in consumer goods and services and shale energy supply shock. All of our disinflationary theories were summarily dismissed by the former Fed economist. While debating the Great Moderation ideolog was an exercise in futility, a simple chart of goods, services and energy price CPI leaves little doubt that the primary disinflationary impulse over the last three decades came from goods prices. In the years following China’s entrance to the WTO that lowered tariffs and boosted their market share of global exports, goods price deflation accelerated. Energy prices plunged in the ‘80s and US production recovered sharply following Reagan’s unwind of Nixon and Carter energy policies. Airfares and transportation costs plunged following their deregulation begun during the Carter Administration. Walmart, followed by Amazon, capitalized on transportation deregulation, globalization and technology innovation to deliver goods at ‘everyday low prices.’ The Fed went from being a cheerleader for technology investment during the Greenspan Fed in the ‘90s to fighting global goods disinflation by boosting domestically determined services inflation during the Bernanke Fed ostensibly due to concerns about policy efficacy near the zero lower bound but in reality, because they had no tools to offset the goods disinflation. Paul Volcker’s contributions to decades of disinflation, while not inconsequential, were unsustainable without these exogenous factors. Consequently, Fed credibility is overrated by the FOMC, their staff, street economists, most of academia and market participants, but not us. Policymakers got us into this mess, markets and the spontaneous economic order will get us out of it.