No Stag, Just Flation

It's not all about Growth, Struggling with Treasury Supply, Above Potential Aggregate Demand, Capex Boom, Tech Earnings Blowout, Will the Chaos Hit the Fan

Scenario Analysis

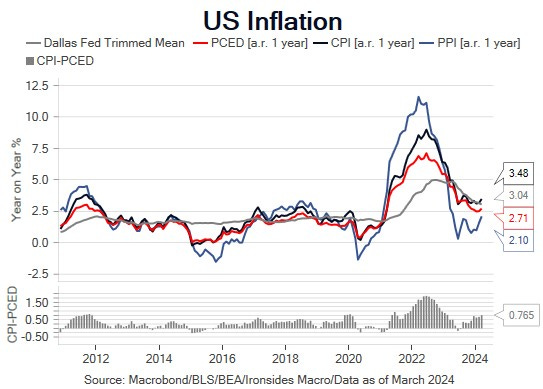

Perhaps the most interesting discussion of our week was with technical analyst John Kolovos about his view that the S&P 500 could have a 10% correction with cyclicals outperforming. Although we have a different process, we share his view and after several convoluted fundamental macro explanations, we arrived at a concise scenario analysis. In short, weaker expected growth is not the only reason the stock market declines. To be sure, earnings are the primary driver of stock prices over time, however in an inflationary regime, real rate shocks reverberate across asset classes and within the equity market the sectors most vulnerable -- banks, small caps, and bond-surrogates, but not technology -- lead corrections. During the early ‘10s, as households and banks were deleveraging, low nominal growth that led to negative operating leverage was the primary risk to equity investors. As we discussed in Macro Regime Change, investors are struggling with the transition from four decades of disinflation to reflation. Thursday’s softer than expected headline GDP, combined with a hotter than expected core personal consumption deflator, was a case in point. As we explain later in the note, underlying demand was far from weak. Consequently, we were not in the least bit surprised that the equity market recovered though the session and finished the retracement in after-hours trading following earnings from leaders in the AI boom. A key theme of the ‘60s investment boom, in sharp contrast to the ‘90s boom, was rising inflation, a bond bear market, and robust earnings growth that drove equity market returns, rather than rising valuation (lower equity risk premium).

As we expected this week, industrial and technology company earnings provided support for the equity market even as the Treasury market required lower prices to absorb $183 billion of supply in the belly of the curve (2s, 5s and 7s). Early in the week the rally was led by small caps, banks, utilities, staples and real estate -- in other words all of the sectors struggling with higher rates and the inverted yield curve. A rally in these sectors is unlikely to be sustainable until and unless next week’s labor market data weakens considerably, and given the April labor data we’ve seen thus far, there is no reason to expect the weak foundation in small business employment to bubble to the surface in next Friday’s crucial report. We remain convinced the most probable impact of next week’s key data, the 1Q24 Employment Cost Index, April ISM Manufacturing, March Job Openings & Labor Turnover Survey, and the April Employment Report, is another leg higher for rates to retest the October 5% high for 10-year nominal Treasuries and 2.5% peak for 10-year TIPS. There are two vital policy events next Wednesday: Treasury’s Quarterly Refunding Announcement, and the FOMC meeting. A shift in issuance to bills, which we described as a band-aid, and the Fed’s pause and bias pivot to cutting rates last October, stopped the last Treasury market led risk-off episode. As we explain later in the note, the Fed and Treasury are unlikely to follow the same playbook following the 80bp increase in 10s since the January employment report, however, Treasury has at least one possible trick up their sleeve.

In this week’s note we will discuss the struggle to finance the largest expansionary budget deficits on record, strong core domestic demand, a coming capital spending boom, earnings season, and what to do if the Treasury market does lead to a cross-asset risk-off episode.