Bretton Woods II

The bond vigilantes, when will teachers go back to school, Bretton Woods II

Powell Has No Idea!

As we watched the market reaction to Fed Chairman Powell’s comments on Thursday, we were reminded of Jim Cramer’s St Louis Fed President Bill Poole rant during the global financial crisis. Taken at face value, Powell’s comments on growth and inflation imply he does not understand the true drive of higher rates in recent weeks is what we described last week as a fiscal dominance real rate regime. In other words, the catalyst is not the improving growth or increasing inflation outlooks, rather $5.3 trillion and counting, of deficit financed fiscal spending. In fairness to Chairman Powell, he may well know this but due to political constraints he cannot articulate this risk. As former Fed Chairman Bill Martin said when the Kennedy and later Johnson Administrations were coercing the Fed into facilitating more expansive fiscal policy, ‘the Fed is independent within the government, not of the government’. In a brief preview to our full subscribers prior to his comments and in our note last week, we suggested the FOMC was some distance from the maturity extension program (Operation Twist). Consequently, the reaction to Powell not hint at hinting at extending the duration of their large-scale asset purchases of Treasuries, was a steepening of the back end of the real rate curve, tighter inflation breakevens, a sharp drop in high growth and valuation equities, the dollar firming against the euro and yen and a decline in bitcoin, in short, his comments triggered risk reduction across asset classes. We are untroubled by this, ultimately deficit financed government spending is reflationary, and it will take some time for reflation to devolve into inflation. We expect inflation breakevens to resume their rate rally, though we are in the ‘sell the reopening trade’ we wrote about a couple of weeks ago. We would add to equity market exposure, in fact on Thursday afternoon we purchased SPYs (S&P 500 ETF) and XLEs (S&P energy sector ETF). Thursday’s low was 5.75% from the mid-February high, we have repeatedly made our case that the necessary condition for a 10% pullback was tighter monetary (tapering asset purchases) or fiscal policy (tax hikes). Given our framework we were compelled to put some capital at risk.

In this week’s note, we are going to analyze the longer-run implications of higher inflation, a more domestic and employment focused policy regime, and deglobalization on the global exchange rate regime, including the dollar’s status as the world’s reserve currency.

Restaurants Reopening, Now What About Schools?

Following December and January reports where weakness in headline payroll gains understated underlying strength and less slack, the February report was flattered by a reversal of December’s sharp decline in leisure & hospitality jobs. Measures of slack that are inputs to our slack model we discussed in last week’s note were mixed, however, weather was the likely culprit with 897,000 unable to work due to bad weather, far above an average February of 309,000 and an additional 1,878,000 who typically work full-time only worked part-time. Additionally, construction employment declined despite the strongest housing starts in 15 years. The employment to population ratio for prime age workers increased from 76.1% to 76.5%, hinting that falling case counts, 2 million vaccinations per day and reduced non-pharmaceutical interventions (NPIs) are gaining traction. Despite the work disincentives in the Biden Rescue Plan and recalcitrant teachers’ unions, we expect strong headline gains in the coming months and diminished labor market slack.

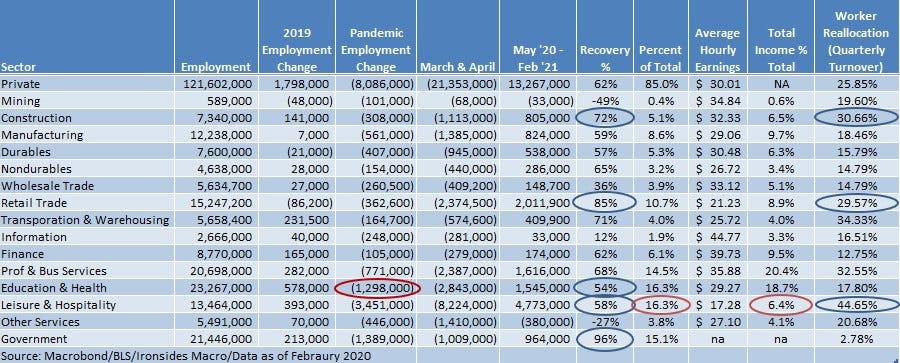

The Chicago Fed research staff wrote an interesting note concluding there has not been significant worker reallocation across sectors, at least as of yet. As we noted very early in the pandemic, the worst affected sectors (leisure & hospitality, retail and construction) were the most dynamic. Additionally, new business creation surged through the pandemic and continues at record levels in 2021. Finally, as we have also noted the ADP data shows small businesses (1-49 employees) have recovered 66% of pandemic job losses, while large (500+) only 42%. We suspect the Chicago Fed’s conclusion is premature, as the NPIs end, we expect strong dynamism despite expanded unemployment insurance, child tax credits, Medicaid and food stamp eligibility and associated benefit cliffs in the Biden Rescue Plan. The JOLTS report will soon return to its status as one of our favorites (it wasn’t timely during the pandemic) given what it tells us about reallocation.

Has Covid-19 Been a Reallocation Recession

The Road to Bretton Woods II?

We have written extensively about the end of decades of disinflation, similarities of the US policy regime to the early ‘60s and most recently, about a real rate regime change that implies the world’s reserve currency is approaching the limit of its borrowing capacity. Most of our focus has been on domestic policy, however the next logical step is consideration of the global exchange rate regime. The developed world monetary policy response to the pandemic has been synchronized, as has the effect of the pandemic and the US and China reached a currency agreement just before the pandemic began. Consequently, the primary driver of exchange rate volatility during the pandemic was the US’s role as the dominant source of safe assets and trade credit that drove the dollar sharply higher, only to reverse as the pandemic panic receded. However, the pandemic and associated shock to global supply chains is likely to accelerate the deglobalization process that was well underway during the last cycle, even prior to the Trump Presidency. This will leave export dependent, current account surplus economies, ranked 2 (China), 3 (Japan) & 4 (Germany) in terms of GDP, with excess goods capacity and an associated incentive to depress their exchange rate relative to the dollar. Additionally, despite the defeat of Donald Trump, the political pressure resulting from the US trade deficit remains acute. The Biden Administration is showing no signs of removing the China tariffs and signed an executive order to force purchases of US products in government contracts. While Treasury Secretary Yellen’s economic ideology is likely supportive of the dollar remaining the reserve currency and generally is supportive of Ricardo’s comparative advantage and free trade, she has also been critical of China’s mercantilist policies and is a labor economist with similar economic ideology to the key economic figure in the Kennedy Administration, Walter Heller. Although the Biden Administration is intent on strengthening European relations, the size of Germany’s current account surplus and European nontariff trade barriers are likely to remain a source of tension. In other words, while the US & China signed an agreement prior to the pandemic, the trade war and deglobalization trend are likely to persist at through the cycle, if not multiple cycles and the dollar’s role as the reserve currency is at the nexus of this conflict. In the near term, notwithstanding our analysis that US monetary and fiscal policy are less efficacious than policymakers believe, US policy is likely to be more effective than our major trading partners. This implies as the pandemic recedes, the dollar is likely to fall in 2021 due to looser effective fiscal and monetary policy.

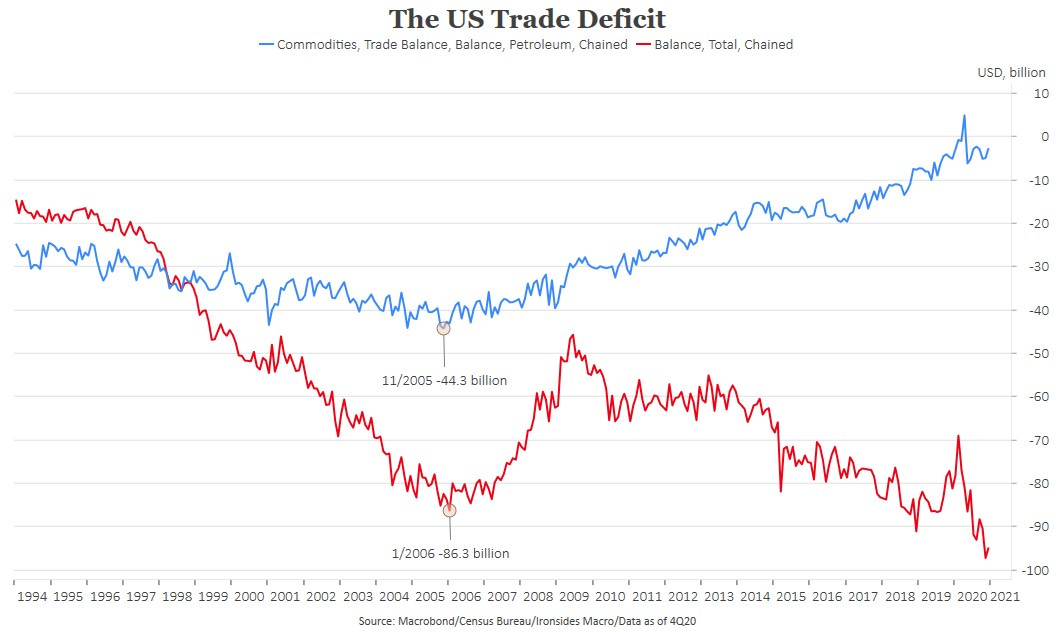

Given our expectations for a reversal in the secular disinflationary trend as deglobalization eases pressures on the primary deflationary impulse, tradeable goods and a policy regime reminiscent of the early ‘60s that led to the Great Inflation, we spent several days researching the demise of Bretton Woods. We extracted quotes (see below) from two papers that capture the flaws in the system. The Triffin dilemma or Triffin paradox, the conflict between short-term domestic and long-term international objectives for countries whose currencies serve as global reserve currencies, was the crucial issue in the ‘60s and we suspect will be problematic in the ‘20s. Milton Friedman and later John Taylor’s policy prescriptions were floating exchange rates and a domestic monetary rules-based system, the antithesis of the authors of Bretton Woods original architecture (John Maynard Keynes & Harry Dexter White). The Kennedy and the Johnson Administration were elected with mandates to focus on domestic policy, that shift in policy focus was initially positive for growth and domestic equities, but after 1965 Johnson’s Great Society and the Vietnam War turned reflation into inflation the pressure on the gold dollar system became unstable. With classic economic liberalism in the minority amongst policymakers in the ‘2020s, another currency agreement combined with more discretionary monetary policy is a possibility if the pressures of deglobalization intensify as we expect. One of the flaws of Bretton Woods was a fixed gold price that suppressed US inflation for a decade, only to lead to explosive inflation when the price constraint was removed. Our chart of the post-WWII US trade deficit is intended to suggest that as the world’s reserve currency, for the world to have a sufficient supply of dollars, the US needs to run persistent current account deficits. This became untenable during over the last two decades as it led to what David Autor calls The China Shock and the election of Donald Trump in 2016. One of the early catalysts for a widening current account deficit in the late ‘60s and ‘70s was the growing US energy trade deficit. The shale revolution ended this dynamic, raising the possibility that the dollar could become a petrocurrency, an outcome that would be troubling for large oil importing economies including China, Japan and Germany (oil shocks could be exacerbated by an associated increase in the dollar).

In a Citi Global Perspectives & Solutions report, Bitcoin at the Tipping Point, they suggest that bitcoin could become the currency of choice for global trade. We are some ways from being convinced by their thesis, the underlying technology is not nearly as efficient as credit card networks, at least yet. Nor do we believe that the interventionist policymakers in the developed world have any interest in replacing the dollar. Nevertheless, with the US likely to pursue inflationary fiscal and monetary policies like the ‘60s that ultimately led to the demise of Bretton Woods, the rise of digital gold may represent the canary in the coal mine for the dollar’s status as the world’s reserve currency. It is important to note that the full convertibility Bretton Woods period from 1959-1970 began as a period of global inflation and growth stability, it was not until US inflation accelerated that the system collapsed. Consequently, our deep dive into Bretton Woods is intended to provide a longer-run road map for the global currency regime and a framework for crypto currencies playing a role in global trade in the ‘20s. We are increasing drawn to the thesis that the weakness in gold, despite increasing inflation expectations, is attributable to bitcoin replacing gold in investor portfolios.

“The system that operated in the next decade (‘50s) turned out to be quite different from what the architects had in mind. First, instead of a system of equal currencies, it evolved into a variant of the gold exchange standard-the gold dollar system.”

“The second important difference between the convertible Bretton Woods system and the intentions of the articles was the evolution of the adjustable peg system into a virtual fixed exchange rate system. Between 1949 and 1967, there were very few changes in parities of the G10 countries (see table 1.2 above). The only exceptions were the Canadian float in 1950, devaluations by France in 1957 and 1958, and minor revaluations by Germany and the Netherlands in 1961. The adjustable peg system became less adjustable because, on the basis of the 1949 experience, the monetary authorities were unwilling to accept the risks associated with discrete changes in parities-loss of prestige, the likelihood that others would follow, and the pressure of speculative capital flows if even a hint of a change in parity were present.”

“In sum, the problems of the interwar system that Bretton Woods was designed to avoid reemerged with a vengeance. The fundamental difference, however, was that the system was not likely to collapse into deflation as in 1931 but rather explode into inflation. “

The Bretton Woods International Monetary System: A Historical Overview (nber.org), Michael D. Bordo

“Truly independent central banks are fair‐weather institutions. When there is any serious conflict between the policies they favor and policies strongly favored by the central political authorities—generally reflected through Treasury policy—the political authorities have inevitably had their way, though at times only after some delay.”

“Friedman also thought that the combination of flexible exchange rates and a domestic monetary rule was more consistent with democratic principles than a regime based on fixed exchange rates and discretionary monetary policy.”

Milton Friedman and the Case for Flexible Exchange Rates and Monetary Rules, Cato Institute

“Where could Bitcoin be in another seven or so years? The report notes the advantage of Bitcoin in global payments, including its decentralized design, lack of foreign exchange exposure, fast (and potentially cheaper) money movements, secure payment channels, and traceability. These attributes combined with Bitcoin’s global reach and neutrality could spur it to become the currency of choice for international trade.”

Bitcoin At the Tipping Point, Citi Global Perspectives & Solutions

Additional Sources:

“A History of the Federal Reserve, Volume 2, Book 1, 1951-1969”, Allan H. Meltzer

“Clashing Over Commerce, A History of US Trade Policy”, Douglas A. Irwin

“1931, Debt, Crisis and the Rise of Hitler”, Tobias Straumann

“The Denationalisation of Money’, F.A. Hayek

“Great Society, A New History”, Amity Shlaes

Key Investable Themes & Beneficiaries:

Global Manufacturing and Trade Recovery: Industrials, Materials, EM Equities

Capital Spending Boom in 2021: Technology, Industrials, Healthcare

Reflation: Materials, Financials, Energy, Small Caps, Inflation Breakevens

Barry C. Knapp

Managing Partner

Director of Research

Ironsides Macroeconomics LLC

908-821-7584

bcknapp@ironsidesmacro.com

https://ironsidesmacro.substack.com

https://www.linkedin.com/in/barry-c-knapp/

@barryknapp

This institutional communication has been prepared by Ironsides Macroeconomics LLC (“Ironsides Macroeconomics”) for your informational purposes only. This material is for illustration and discussion purposes only and are not intended to be, nor should they be construed as financial, legal, tax or investment advice and do not constitute an opinion or recommendation by Ironsides Macroeconomics. You should consult appropriate advisors concerning such matters. This material presents information through the date indicated, is only a guide to the author’s current expectations and is subject to revision by the author, though the author is under no obligation to do so. This material may contain commentary on: broad-based indices; economic, political, or market conditions; particular types of securities; and/or technical analysis concerning the demand and supply for a sector, index or industry based on trading volume and price. The views expressed herein are solely those of the author. This material should not be construed as a recommendation, or advice or an offer or solicitation with respect to the purchase or sale of any investment. The information in this report is not intended to provide a basis on which you could make an investment decision on any particular security or its issuer. This material is for sophisticated investors only. This document is intended for the recipient only and is not for distribution to anyone else or to the general public.Certain information has been provided by and/or is based on third party sources and, although such information is believed to be reliable, no representation is made is made with respect to the accuracy, completeness or timeliness of such information. This information may be subject to change without notice. Ironsides Macroeconomics undertakes no obligation to maintain or update this material based on subsequent information and events or to provide you with any additional or supplemental information or any update to or correction of the information contained herein. Ironsides Macroeconomics, its officers, employees, affiliates and partners shall not be liable to any person in any way whatsoever for any losses, costs, or claims for your reliance on this material. Nothing herein is, or shall be relied on as, a promise or representation as to future performance. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.Opinions expressed in this material may differ or be contrary to opinions expressed, or actions taken, by Ironsides Macroeconomics or its affiliates, or their respective officers, directors, or employees. In addition, any opinions and assumptions expressed herein are made as of the date of this communication and are subject to change and/or withdrawal without notice. Ironsides Macroeconomics or its affiliates may have positions in financial instruments mentioned, may have acquired such positions at prices no longer available, and may have interests different from or adverse to your interests or inconsistent with the advice herein. Ironsides Macroeconomics or its affiliates may advise issuers of financial instruments mentioned. No liability is accepted by Ironsides Macroeconomics, its officers, employees, affiliates or partners for any losses that may arise from any use of the information contained herein.Any financial instruments mentioned herein are speculative in nature and may involve risk to principal and interest. Any prices or levels shown are either historical or purely indicative. This material does not take into account the particular investment objectives or financial circumstances, objectives or needs of any specific investor, and are not intended as recommendations of particular securities, investment products, or other financial products or strategies to particular clients. Securities, investment products, other financial products or strategies discussed herein may not be suitable for all investors. The recipient of this report must make its own independent decisions regarding any securities, investment products or other financial products mentioned herein.The material should not be provided to any person in a jurisdiction where its provision or use would be contrary to local laws, rules or regulations. This material is not to be reproduced or redistributed to any other person or published in whole or in part for any purpose absent the written consent of Ironsides Macroeconomics.© 2021 Ironsides Macroeconomics LLC.