A Whole of Government Approach

2025 Outlook Preview, Coordinating Treasury Issuance and Monetary Policy in '25, Labor Data and Monetary Policy

Next Week we will release our 2025 outlook, here is a look back at last year’s forecasts.

2024 Outlook

Key Forecasts

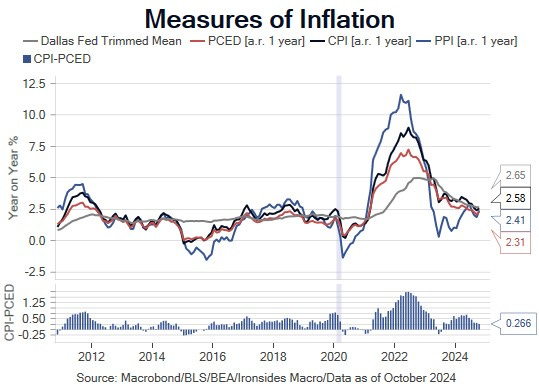

Inflation: Core disinflation but only to the top of the FOMC’s 3%-2% comfort zone

Unemployment: Headed well above 4%, likely to be the trigger for the coming Fed pivot

Growth: Consumption and investment are slowing, but unlikely to go significantly negative

Earnings: Weaker than forecast 1H24, leading to mid-single digit growth, below consensus of 11%

Fed Policy Rate: First cut in March, 100bp total will stabilize the bank credit contraction

S&P 500: The first 10% move likely to be down to 4100, followed by a recovery in 2H24 to 5100

USTs: Curve disinversion by mid-year, slightly higher back-end rates at YE24

Sector Allocation: Overweight Industrials, Materials, Energy, Underweight Financials & Small Caps

How We Did

Core inflation has proven sticky and as we expected is closer to 3% than the FOMC’s target. Unemployment is above 4%, though at this point not well above, it was the trigger for the recalibration process that started later than we expected but is on track to meet our 100bp reduction forecast. The first S&P 500 pullback didn’t occur until April, there was another in July, but it surprised anyone foolish enough to put a price target on paper. The 2s10s curve disinversion was delayed until September due to the delayed start to Fed easing, the crucial 3m10y banking business model proxy remains inverted. We changed our stance on financials early on when it became clear the Biden administration’s bank regulation appointees ill-advised bank capital proposal was doomed. We stuck with our negative outlook on small caps until the election. Industrials and our healthy allocation to technology and communication services worked well, energy lagged but following the election we are even more bullish on the sector. We held a healthy cash allocation through most of the year, however our aggressive sector allocation led to strong returns. We generally got our calls on the Treasury market right; we expected fewer cuts than the market but higher longer maturity rates as the market struggled to absorb supply despite Treasury Secretary Yellen and undersecretary Josh Frost keeping their thumbs on the scale by issuing more bills than the Treasury Borrowing Advisory Committee recommended proportion of total issuance. We also got the election outcome correct.

Outlook notes are an important part of the investment strategy process, it forces the strategist to lengthen their forecast time frame to match the way most investors invest. After spending decades on Lehman Brother’s equity derivatives trading desk, the most important step in the transition to research was focusing on durable ideas and themes. Later this month we will release our secular thematic annual note that forces us to consider even longer investment horizons. We enjoy steeping back and forcing ourselves to consider the longer run, however, our weekly guidance is the real value-added we provide to our clients. There are a few of us that left the street in recent years and offer institutional quality strategy research to both investment management and sophisticated individual investors. We think our product is unique in the breadth of policy and economic analysis and asset allocation strategy.