A Real Bear Steepener

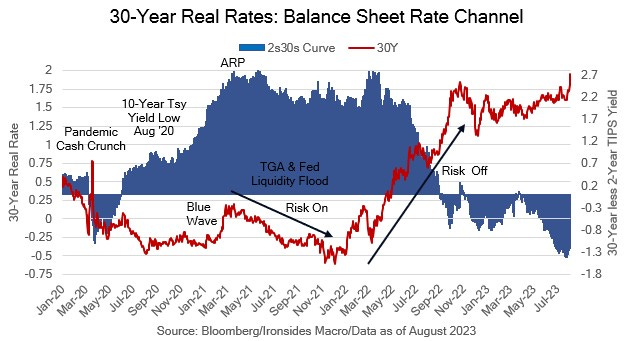

Two weeks ago, in Unstable Equilibrium, we discussed the deep yield curve inversion and potential disinversion/steepening scenarios. From a markets and macroeconomic perspective, bull steepening (rates lower) due to the Fed reversing some of the rate hikes is preferable, although rate cuts driven by falling inflation rather than lower employment and growth is a far more benign outcome. The risk-off/equity correction scenario is bear steepening (long rates higher) led by higher longer maturity real rates (TIPS). At the expense of oversimplification, let’s discuss the implications for equities of these scenarios.

To start, consider a simple valuation model, the equity risk premium defined as the expected earnings yield less real 10-year Treasury rate. We use the real rate because the book value of equities and earnings include both price and volume, therefore they increase with inflation while nominal Treasuries return par regardless of what happens to inflation over the life of the bond. In other words, equities perform better than bonds when inflation accelerates, at least until there is a monetary policy response. Consequently, all things equal, higher real rates imply lower equity market valuation. To be sure valuation is not a timing tool, but high velocity increases in real rates lead to risk-off shocks. Many of those moves were associated with monetary policy normalization including, ‘94, ‘04, ‘10, ‘11, ‘13 (Taper Tantrum), ‘18 (two episodes), and ‘22.

Of course, in the three disinversion scenarios, all things are not equal. Yield curve disinversion due to the Fed cutting rates because growth, employment and inflation contract imply lower earnings. Yield curve normalization from the deepest inversion since December ‘80 during the Volcker Fed regime due to falling inflation, partially attributable to faster productivity growth, is what the equity market has been hinting at. Over the last week, since the Bank of Japan announced the beginning of the end of yield curve control and Treasury announced ~$500 billion more in issuance than expected for Q3 & Q4, primarily in coupon securities, the 2s10s real rate curve steepened 33bp leading to the pre-payroll’s equities and Treasuries sharp moves lower. Given that the starting point for the steepening was 135 flatter (more inverted) than in March, we doubt the current move is sufficient to cause a significant correction, but for those inclined towards tactically trading, index puts make sense due to unfavorable seasonality for Treasuries that could contribute to 10s exceeding last October’s 4.24% cycle peak. For those more strategically inclined, an opportunity to deploy cash could develop, in other words down 5-7% with 10s above 4.25% is likely to be a good entry point given our outlook for core disinflation continuing through 1Q24.

This week’s data and earnings reports was supportive of the disinflation outcome. In particular, the 3.7% increase 2Q labor productivity was consistent with our view that worker reallocation from mid-’21 through mid-’22 was a major contributing factor to faster wage growth. Softer labor market demand stopped the developing risk-off shock, but the message is clear: the magnitude of the curve inversion due to a suboptimal monetary policy tightening process left the economy, markets and banking system in an unstable equilibrium.