We told you a note was unlikely this week, we managed to sneak in a shorter than normal one prior to our trip.

Jackson Hole

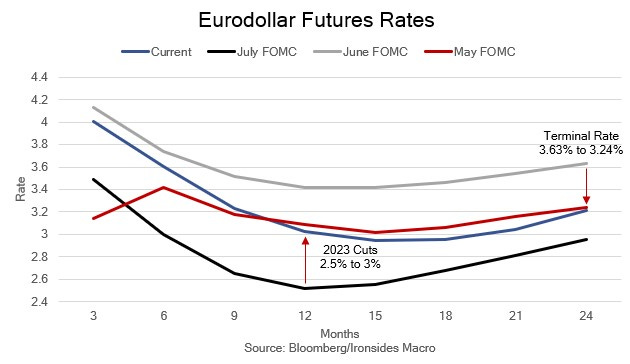

We titled this note “A Mini Tantrum’, prior to the violent equity market reaction to Chairman Powell’s not particularly hawkish speech. Our characterization might strike our readers as curious given the 337bp plunge in the S&P 500 lead by technology and related sectors. Despite the nasty reaction in equities, there was a far more muted reaction in Treasuries and exchange rates. Additionally, the Chairman offered no forward guidance and the important data released 90 minutes before his speech argued for 50bp in September. In other words, our peak tightening expectations in June following the first 75bp hike view remains intact. That said, we were expecting an aftershock from the mother of all taper tantrums, and Friday’s close at 4057 is within 100 points of what we had in mind. It seems a bit soon for a sufficient amount of fresh short positions to be reestablished to create the conditions for another sharp rally. Still, price is important and our conviction in our longer-term view that we have passed both peak inflation and peak tightening expectations increased on Friday following the softer than expected personal consumption deflator report, University of Michigan inflation survey and Chairman Powell’s speech. We would be a buyer below 4000 on the S&P 500. On another note, we read the first two speeches on the first leg of our trip, the research on hours worked and potential impact of work-from-home was interesting. The second paper on productivity was typical of the economics profession these days, they focused on government statistics, ignored corporate level data and in our view, reached a spurious conclusion that the pandemic slowed productivity growth. More on this topic later, spoiler alert, GDI was positive again in 2Q.

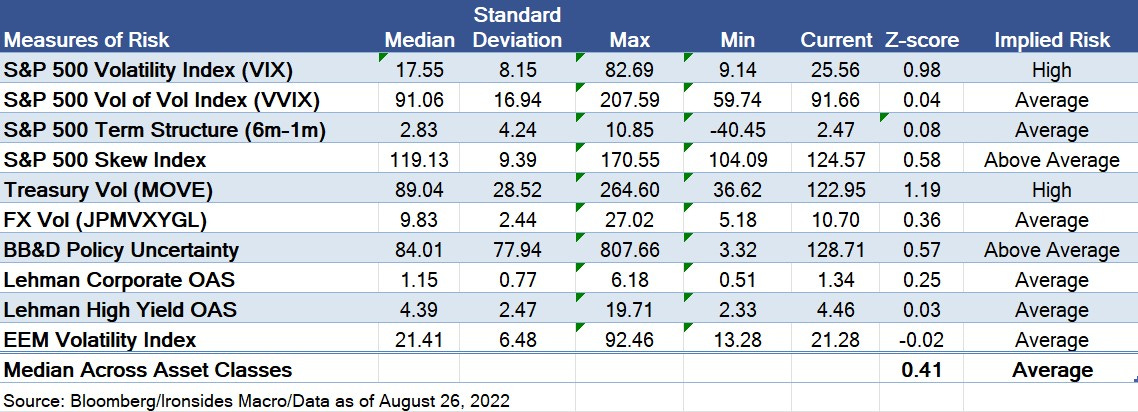

In the lead up to Jackson Hole, the ‘The Soft Underbelly’ (5–10-year maturities) did absorb the brunt of the selling in the Treasury market, however, 2/3’s of the 20bp increase in rates was attributable to breakeven inflation, with real rates lagging behind. No doubt the 4% rally in crude oil and 2% rally in natural gas played a role in increasing market-based inflation expectations, and while market implied inflation expectations are below the 4% level that we expect to act as a floor, real rates are even more mispriced due to the stock of Fed holdings of Treasuries, TIPS and mortgage-backed securities. Additionally, the 17bp increase in 2-year notes, partially attributable to the hawkish forecasts from regional Fed bank presidents, implies investors appear to have forgotten the Fed is out of the forward guidance business. More notable was the MOVE Index retracing more than half of the decline from the early July peak and Fannie Mae current coupon rate spread to 10-year interest rate swaps rebounding to the widest level in the history of securitization (~140bp). It could be that the market is anticipating the Fed talking about, talking about, selling mortgages. The final paper on Saturday focuses on the balance sheet, it will not be available until after you receive this note. One final point on Jackson Hole, next Friday’s employment report is more important than Chairman Powell’s speech in terms of the rate policy path. The speech did not appear to have been modified after the soft inflation report, it seems probable the ‘slowing the pace of hikes at some point’ is shaping up for September.