2Q Outlook: Disinflation Intact

Disinflation trend intact, a second wave of deposit outflows, slowing growth, structurally higher interest rate volatility

2Q Outlook: Disinflation Intact

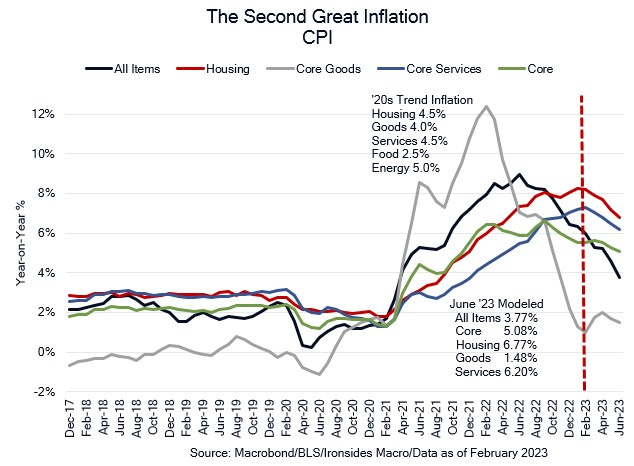

In our 2023 Outlook note; 9 to 4, but then what, we expected the dominant macro theme through 1H23 to be disinflation. Despite the pandemic related distortions to seasonal adjustment factors intended to smooth economic data that led to suspiciously strong January inflation, employment and retail sales, the disinflationary trend redeveloped in the February inflation reports. If we accept Chairman Powell’s inflation framework — core goods, shelter and services less rent of shelter — as likely to drive the Fed’s policy reaction function, our outlook is favorable. Core goods prices was the source of disinflation in 2H22 and early ‘23, as the 6-month annualized rate cooled from 11% in February ‘22 to -1% in February ‘23. In 1H23 all items CPI and PCED will be pushed lower due to lapping the Russian invasion related spike in food and energy. From 2Q23 through 3Q23 services less rent of shelter annualized measures is likely to fall due to hot comps thanks to the surge in demand for services in 2Q-3Q22, this measure peaked in September ‘23 at 9.5% 6-month annualized and was 3.9% in February. Finally, the goofy shelter measures will begin to contract in 2H23, a full year after house prices and rents peaked and began an even sharper deceleration than from the 2006 peak.

We describe the measures pejoratively because on a 6-month annualized basis, CPI rent of shelter is still accelerating (9% in February), while the Apartment List Rental Index cooled from a 6-month annualized 13.7% rate in July to -4.4% in March, following a -6.1% rate in January and February. The Case Shiller 20-City Composite Index, using the same rate of change, cooled from 22.6% in April ‘22 to -8.1% in January, a sharper deceleration than during the ‘00s housing crash. Our assertion that disinflation is the dominant macro theme might strike some as curious in light of the banking crisis that has taken most of our attention in recent weeks. As a glimpse of year-to-date performance, the S&P 500 +7%, 2-year UST yields -40bp, 5s -43bp, 10s -41bp, a parallel shift lower, and investment grade and high yield CDX spreads tighter by 6 and 21bp, is what we expected despite the Fed’s overreaction to distorted January data that triggered the banking crisis. The 2s10s breakeven curve is 39bp inverted from flat at year-end ‘22, the Fed 5y5y forward breakeven inflation (long-term market expectations) is 2.27%, little changed in 1Q23, and household inflation surveys eased in 1Q. Markets and the public are on board with the disinflation theme.

The upshot is that nothing that occurred in 1Q23 dissuaded us from our conviction that the central theme of 2023 is disinflation, but there is no viable path back to sub 2% trend all items CPI or PCED. Deglobalization and the most expansionary federal government outlays and deficits outlook since the ‘60s and ‘70s implies trend inflation above 3%. The best we can hope for is a low standard deviation of inflation, like the ‘90s when CPI averaged ~3.5% with an annual standard deviation of 40bp.