Where Did Secretary Yellen's Customers Go?

More Bear Steepening, Disinflation Trend Persists, Chinese Clogged Channels, Joe Six Pack in Focus

The Battle of the Bonds

With the exception of the large retailers, the best earnings season (relative to expectations) since 2021 is largely behind us. Similarly, the easy comparison portion of the headline disinflation process is also in the rear-view mirror. As a result, we can see that the reaction of the long end of the Treasury curve and stock market to this week’s Treasury quarterly refunding indicated the adjustment to Treasury Secretary Yellen losing her best customers, just as she has an extra $500 billion of coupons for sale, implied the correction in equities and Treasuries is not yet complete. FOMC open mouth operations early in the week hinted at a growing faction hold the view that policy is at least sufficiently restrictive, and they therefore favor an end to the hiking process.

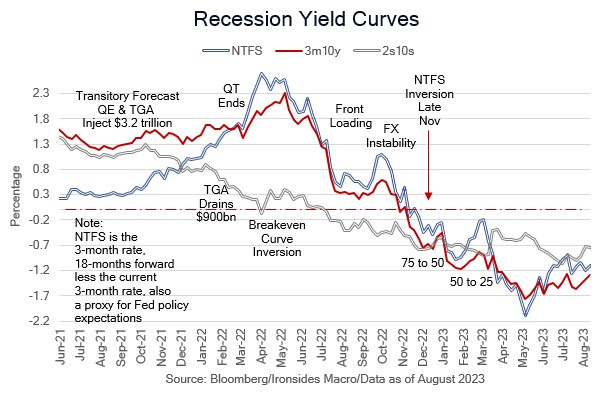

For our part, the last three hikes bordered on reckless and led to an unstable equilibrium between, on the one hand, an underleveraged household and large nonfinancial corporate sector that has termed out their liabilities, and on the other, small and midsized banks, as well as small businesses generally, that are showing increasing signs of stress due to the magnitude of the yield curve inversion with only three, not pleasant, precedents in US history (‘73, ‘79 and ‘80). Moody’s downgrades and credit watch for a number of regional banks and ZipRecruiter’s pulling of guidance and CEO commentary about small business labor demand during their earnings report, captured these related risks.

The auctions highlighted the unstable equilibrium: demand for the 3-year was exceptional, as you would expect given a Fed coming to the end of the most aggressive rate hike cycle since Volcker and the inverted curve that makes the front-end attractive. The 10-year auction, the day before CPI, went reasonably well. Only hours after a favorable CPI report however, the 30-year auction was poorly received and everyone who didn’t sell their 10s they bought at a 3.99% rate was underwater and the losses deepened as 10s traded through 4.15% after a modestly worse than expected PPI report Friday. Can we attribute the 3% pullback in the S&P 500 and 40bp backup in 10-year rates, 32bp of which is the real component, to late summer illiquidity? We think not. In our view the concession to excess Treasury supply is insufficient to create an attractive tactical opportunity in equities or fixed income, 10s above 4.25%, 10-year TIPS near 2%, and equities down 5-7% could be interesting given that the path to a bull steepener disinversion driven by disinflation, rather than lower employment, remains a reasonably plausible outcome. In this week’s note we will work through the inflation data, supply and demand dynamics in the Treasury market, why China’s policy transmission channels are clogged, and take a look ahead at next week’s consumption data.