Three Questions

Slower and further, CPI base effects, labor market cracks and falling earnings revisions

We used this new chat feature to relay our first thoughts during the FOMC press conference, on a flight no less. The plan is to use this feature for important data releases and market events. We prefer communicating directly with subscribers rather than Twitter or other social media platforms. Please let me know your thoughts. Substack released the iPhone version, Android is coming soon followed by a desktop version.

How Fast, How Far, How Long?

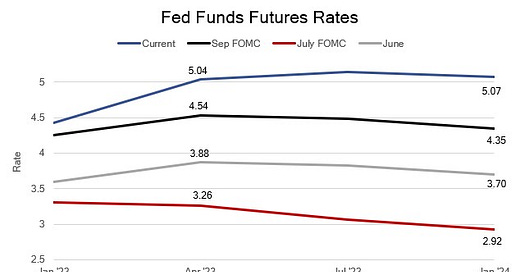

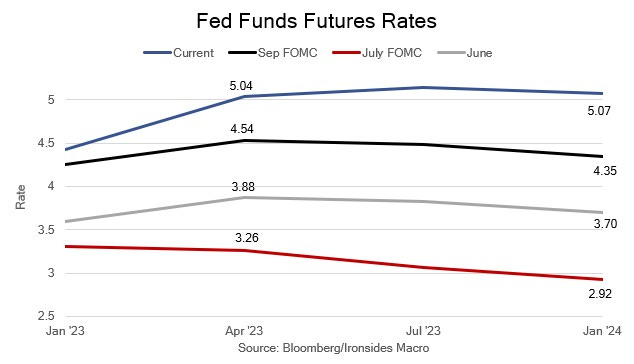

After the September FOMC meeting financial conditions became unstable. The pound flash crash, yen intervention, impulsive mortgage spread widening, and sharply higher interest rate implied volatility were the most notable examples of this instability, making it necessary for the Fed to consider slowing the pace of tightening (how fast). Data released between the September and November meetings showing resilient labor demand convinced the Chairman, but perhaps not the Committee, the terminal rate is likely higher than the September summary of economic projections forecast of 4.6% (how high). Assuming they slow the pace, and the terminal rate is higher, this lengthens the process (how long). Consequently, the Dec 22-23 Eurodollar curve flattened (no rate cuts in ‘23), and the Dec 23-24 curve steepened (cuts in ’24), while the high valuation, high growth equity sectors led the sharp drop in the equity market until Friday’s weak labor report (we’ll get to that assertion). The FOMC communique, typically a concise document under Powell’s leadership, included new verbiage that confirmed the slowing pace of hikes and acknowledged the risks of the lag effect of policy on economic activity and inflation as well as heightened financial (in)stability risks. The statement did not hint at a higher terminal policy rate. This could be because the developing dovish dissenters do not agree. As we will discuss, Chairman Powell may want to keep the window for a year-end risk on rally closed, but weakening fundamentals are likely to make his terminal rate forecast too high. Slowing the pace is crucial for financial stability, the real rate curve is little changed from the September meeting, hinting we are getting close to the end game.