U.S. Economy 'Not as Robust' as We Think?

Our appearance on the Schwab Network from Tucson on Friday

A Macro Man Takes Over the Debt Mess

The Yellen Treasury regime is coming to an end, and the transition can’t come soon enough. The decision to inject $1.55 trillion during the first 9 months of ‘21 by reducing issuance and drawing down the Treasury General Account, alongside a $1.9 trillion fiscal stimulus package, with the Fed continuing their large-scale asset purchase program (QE) that created an additional $1.5 trillion of bank reserves, was reckless and was the primary cause of the inflation shock. Toss in the decision to end the pandemic exemption to the Supplementary Leverage Ratio for cash and Treasuries, leading to major banks turning away large institutional deposits, and the some of the excess liquidity found a home in some very unsafe hands, like Silicon Valley Bank. Rather than addressing their role in the largest inflation shock since the Great Inflation, the Yellen Treasury decided to roll the dice on transitory inflation and has financed their debt bomb with a heavy dose of Treasury bills. In January, assuming a smooth Senate approval process, we will have a strategic macro thinker back in charge of Treasury, though unlike former Secretary Mnuchin, Scott Bessent has been dealt a far more difficult hand.

Bessent certainly would have been our first choice of the candidates, however, as we have been discussing in recent weeks, stabilizing longer maturity Treasuries requires reducing spending back to 20% of GDP from the 24% path the Biden Administration paved for the last three years, and the next 10 years according to the Congressional Budget Office (CBO). The first step is the continuing resolution (CR) temporary agreement that expires on December 20th. Our preference is another short-term CR that forces the budget to be one of the first agenda items for the incoming Trump Administration. An important benefit from starting the budget reconciliation process early in ‘25 is the expected boost to business confidence from making the Tax Cuts & Jobs Act (TCJA) corporate tax rates permanent, as well as renewing the favorable tax treatment for equipment and R&D investment. Trump Administration policy sequencing is important, as we discussed last week, the 2017 corporate tax cut agenda got delayed by the attempt to repeal & replace Obamacare, when it finally passed, the boost to business confidence was offset by trade policy and the resultant global manufacturing recession. We suspect multinationals and importers are more prepared for a second Trump administration but stabilizing the Treasury market and boosting business confidence, prior to or at least simultaneously with, focusing on trade policy, would provide considerable policy space.

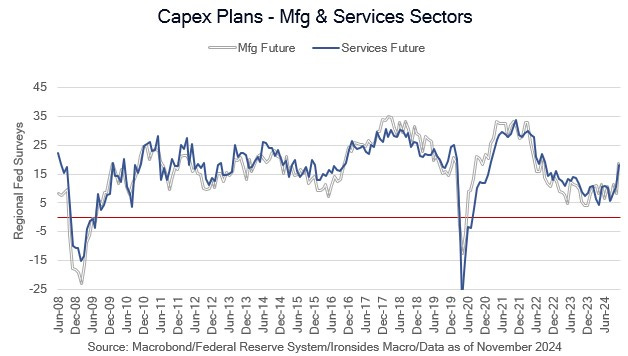

In Bessent’s first interview after President-elect Trump nominated him, he prioritized making the TCJA cuts permanent. His version of Japanese Prime Minister’s Three Arrows, a 3% deficit, 3% growth and 3 million additional barrels of oil are consistent with our views that most important agenda items for the Trump economics team is stabilizing the debt and facilitating a long overdue capital spending boom. In a related note we provided a link to Bettering Human Lives, from Liberty Energy’s CEO Chris Wright. We had heard Wright was a candidate for energy secretary, and sure enough he was nominated last week. Wright’s goal of Zero Energy Poverty by 2050 is a far more humane goal than Zero Net Emissions. Our contacts were thrilled by this nomination, and we are incrementally more bullish the energy sector.

In this week’s note we discuss the evolution from industrial policy to market driven supply side policy, discuss early evidence of a recovery in capital investment and the boom we expect to develop, preview upcoming data and provide our updated market thoughts.