The Threat to Bureaucracy

The Red Wave Crushes Volatility, Threat to Bureaucracy, Tax Cuts & Tariffs don't cause inflation, Recalibration Pace & Destination, Leaning into the Red Wave

I will be joining Mike Green & Harley Bassman on Simplify Asset Management’s webinar series, Keeping it Simple, Thursday November 14th at 4:30 Eastern. Please see the link to register.

The Red Wave Implied Volatility Collapse

As we expected, albeit with a measured level of conviction due to political polling response rates even lower than Bureau of Labor Statistics labor surveys, we did get a Red Wave (betting odds on House control are at 97% with a handful of seats remaining). Our market positioning thesis, what they pay (option markets) is more important than what they say (investor surveys), worked well as betting markets proved more reliable than traditional polls. We thought the economic fundamental case for the GOP was compelling and would carry the day, but we are biased observers because we always weigh economic factors at the top of the list. In broadest terms, the election outcome is very likely to boost business confidence, like the passage of the Tax Cuts & Jobs Act, leading to a recovery in capital, and to a lesser extent, labor investment in 2025. The issues with the cost and supply of credit for small business resulting from monetary policy tools working at cross purposes remain unresolved, but as we will explain our analysis of Chair Powell’s minimalist press conference this week, the FOMC recalibration process appears on a path to a 4% policy rate shortly after inauguration day.

To be sure, the sharp rally in equities and 10-year USTs back to the key 4.30% level after an election night surge, are partially attributable to the collapse in implied volatility as evidenced by the VIX dropping from 22% to 15% and MOVE Index falling from 130bp to 100bp. A simplified explanation is that the liquidation of portfolio insurance puts generated a large portion of the buying the boosted stock and bond prices in the days following the Red Wave. Within fixed income, the most notable manifestation of this dynamic was the 20bp tightening of the spread of agency mortgage-backed securities to Treasuries, holders of mortgage bonds are short the prepayment call option. Another interesting reaction was the tightening of 10 & 30-year swap spreads, we expected market participants to take the incoming Trump Administration’s pledge to reduce spending seriously over time, the tightening of swap spreads implies market participants are not panicking about the fiscal outlook. Gound zero for President Trump’s threat to bureaucracy is financial sector equities, as we will discuss in the next section, the response to the Red Wave was unequivocally positive for banks due to expectations of a more rational regulatory and mergers & acquisitions regime.

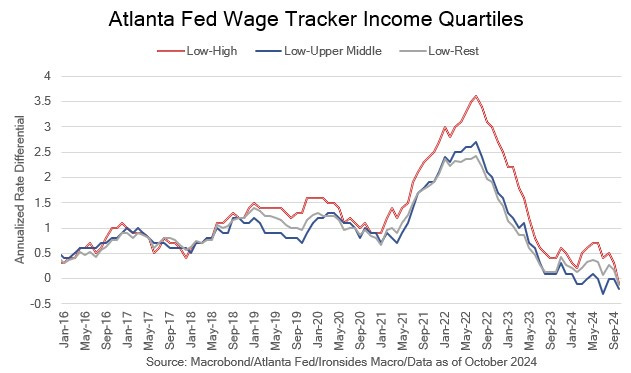

President Trump is not inheriting a great economy as the new-Keynesian disciples assert, employment growth in the foundation of the labor market, small businesses, has slowed to zero. Corporate earnings, outside of the technology and communication services sectors benefiting from the Gen AI investment boom, increased a tepid 3% in 3Q, with industrials sector earnings falling 8.8%. The rate of change of earnings growth, and the leading indicator for earnings momentum, net revisions, are powerful drivers of valuation. In other words, when estimates are rising the market multiple more often than not, is expanding. At present, estimates for 4Q24 and ‘25 are edging lower and net revisions on most economically sensitive cyclical sectors are negative. Manufacturing, housing, small banks and small businesses are dealing with contracting demand and supply constraints. We’ve been arguing for 18 months that the Fed’s pandemic easing and delayed response to ‘transitory’ inflation exacerbated household, and importantly, small relative to large banks and businesses, which exacerbated inequality by tightening financial conditions for floating rate borrowers while leaving balance sheet accommodation for fixed rate borrowers and owners of financial assets largely intact. The release of the October Atlanta Fed Wage Tracker income quartiles illustrates the issues created by fiscal and monetary policy over the last four years. While the lowest income quartile relative wage growth surged following the American Rescue Plan Act $1.9 trillion stimulus, real wage growth contracted. When the rate of inflation cooled, the lowest income earners relative wage growth collapsed and is now weaker than during the pre-pandemic period following the passage of the Tax Cuts & Jobs Act.

In this week’s note we will provide some additional thoughts on the fiscal and monetary policy outlook, explain why tax cuts and tariffs don’t cause inflation, offer a short inflation week preview and discuss sector and asset allocation changes.