The Policy Mosaic End Game

Detoxing the labor market, fiscal inflation, the Fed's blind spot, uneven earnings growth, another FOMC step towards neutral, the end of QT

In this week’s note:

Three shocks, reduced government spending, immigration and tariffs, are contributing to a sharp deceleration in employment growth.

The even larger negative contributor to weak employment is the Fed’s rate policy, another 75bp will ease policy to a neutral setting.

With Fed easing, the stage is set for stronger growth in ‘26. A recovery in the labor market in early ‘26 is the crucial signpost to determine the efficacy of the Trump Administration’s policy mosaic.

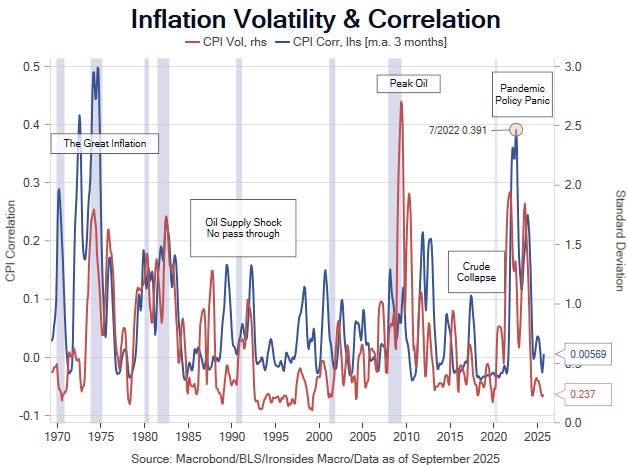

CPI missed expectations, while lag impaired rent of shelter was the largest drag, the more important factor is the sharp deceleration of government spending on non-housing services (super core) inflation.

Super core CPI heated up from 3% to 5% amidst 11% government spending growth in fiscal year ‘24 (ended September) and returned to 3% during FY25 was government spending growth decelerated to 3% growth. This is not a coincidence.

Earnings surprise is similar to the last few quarters and stocks are responding favorably, but the yearly estimate is not increasing much and margins for consumer companies are under pressure.

The Fed is set to take another step towards neutral rate policy and end QT but curb your enthusiasm about the end of large-scale asset purchases because the Fed needs to lengthen the SOMA portfolio duration.

Gold, bitcoin, and global capital account rebalancing