The Petrodollar

The big number you missed, skip or a new debate, CPI preview, the Petrodollar, equal or cap weighted S&P

Don’t Fight the Fed, Anticipate Them

In last week’s note, The End of the Hiking Cycle, we discussed the evolution of FOMC participant views. The hawks — including Cleveland Fed President Mester, Governor Waller and Chair Powell — appeared to be softening their stance toward the views of more dovish members on the credit, policy lags, demand for labor, and the role of wages in the inflation process. While we inferred Waller’s softening stance on additional hikes, his Tuesday morning CNBC interview empathically confirmed the evolution of his views.

There was only one data release that really mattered this week for the policy, growth or inflation outlook, and it wasn’t the August ISM Services Survey increasing to 54.5 from 52.5. As noted by Peter Boockvar, author of one of our recommended publications, The Boock Report, ISM’s survey is biased towards larger companies relative to the S&P Global Services PMI that slipped from 52.3 in July to 50.5 in August, a number consistent with softening August credit card data. The really important report didn’t get any press coverage, perhaps because it doesn’t appear on Bloomberg’s ECO function or other similar economic calendars. We look at a range of wage indicators, including average hourly earnings, the quarterly employment cost index and the Atlanta Fed Wage Tracker, the under the radar number of the week released on Thursday. Because the latter two are less timely, the most closely watched measure is the average hourly earnings series released with the biggest economic report of every month, the employment situation (payrolls) report. The headline series has a range of issues including industry and demographic mix shifts, as well as issues with supervisory bonuses and benefits. We prefer the nonsupervisory series for its longer history and fewer issues with noncash compensation, but the mix shift issues are still evident.

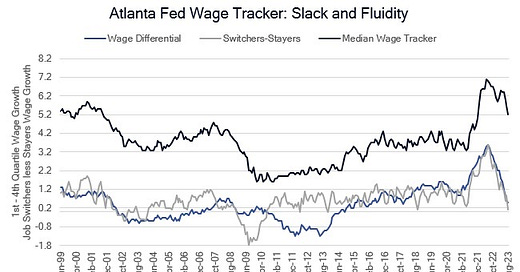

The Atlanta Fed Wage Tracker adjusts for mix shifts, but due to the monthly volatility of the data they smooth the data over 3 months, rendering it less timely. The smoothing process made the sharp drop in the headline series (wage tracker overall) from 5.7% in July to 5.3% in August all the more impressive. The data was even more robust when you consider that the spread between the lowest and highest income quartiles, a measure of labor slack, slipped to 0.5% after beginning 2023 at 2.7%, which is consistent with the eight consecutive months of negative revisions. Even more impressive, given that our analysis attributes more of the wage level shock to reallocation (churn) than diminished slack, was the drop in the spread between job switchers and stayers to 0.1% from 0.9% in July, and 2.2% in December ‘22. Both of these measures peaked at 3.6% in July ‘22, four months after the peak in average hourly earnings, and have returned to the bottom end of their late ‘10s expansion range. Correlation doesn’t ‘prove’ causation of course, however, the switchers/stayers spread explained 37% of the change in the median wage tracker pre-pandemic and 57% from June ‘20, while the income differential measure explained 73% pre-pandemic, and 49% since the pandemic. The Chicago Fed labeled the pandemic labor market as the Great Reallocation, rather than the Great Resignation, and we agree. Whether FOMC participants attribute the pandemic related spike in wage growth to diminished slack or churn, both are more than fully normalized in our view.

The bottom line is that the labor market is close to its pre-pandemic, low unemployment, productivity adjusted, stable wage growth environment. The reduction in the quits rate, lower reallocation, collapse in the spreads between switchers and stayers and income quartiles, as well as persistently negative revisions to employment, are significant warning signs that there may be a more insidious underlying trend than FOMC participants’ characterization of labor demand as ‘returning to balance’.

The resurgence of the bear steepening following the friendly August employment report that extended early last week was primarily driven by investment grade corporate supply and Asian exchange rate weakness (JPY and CNH back to last October ‘22 lows). With nominal 10s near 4.25%, and real 10s (TIPS) just shy of 2%, in the vicinity of our estimates of Fed balance sheet adjusted fair value, it would take a significant shock to push them much higher. The data and Fed speeches prior to the September meeting quiet period increased our conviction that the most aggressive rate hike cycle since the Volcker Fed is over. Consequently, our forecast for a complete retracement of last year’s S&P 27% drop, extending this year’s rally to 4800, remains our base case.