The Misunderstood Macro Environment

Upside down growth, goods supply curve shift, Treasury already did QT, cyclicals ready to rip

The Misunderstood Macro Environment

The stock market is not the economy, and it has predicted 9, soon to be 10, of the last 5 recessions. Retailer earnings, bank CEO commentary, global PMIs, durable goods and jobless claims quieted recession hysteria last week. We would hardly describe the macro environment as ‘just right’ (Goldilocks), however the market mood swing from scalding hot to ice cold was primarily attributable to fiscal, monetary and Treasury Department liquidity injections in 2021 and reversals in 2022 (more on this later), not economic activity.

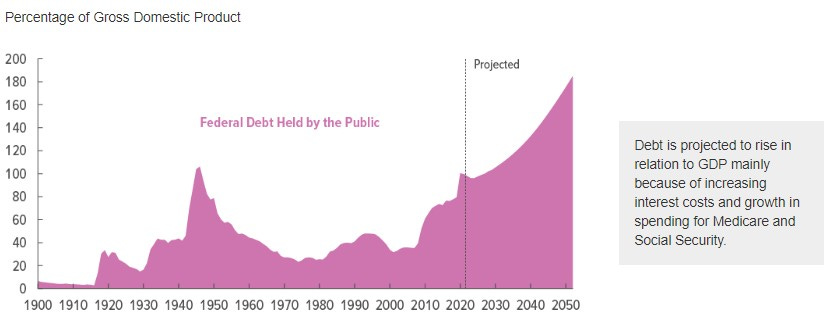

As we reflected further on the MacroMinds conference, had some of the astute investors (see link to the agenda) uncovered systemic levels of leverage in private credit financing residential or commercial real estate, subprime autos, private equity, crypto venture capital, SPACs or any other nonbank financed investment, we might have had to rethink our view that the limiting factor for Fed rate hikes is Federal finance, not the private sector. Instead, our conviction remains that inflationary federal debt accumulated following the financial crisis and the pandemic, far more so than deflationary private sector debt, will be the overarching leverage issue through the ‘20s. The tip of the iceberg is the Fed’s SOMA portfolio. A WSJ story this week, Higher Rates Raise Risk of Future Fed Losses, described how the average yield of 2.3% on $8.5 trillion of assets, financed by $3.5 trillion in reserves, will lead to capital losses if the policy rate reaches 3.5%. Of course, government accounting will merely declare this a deferred asset, however as we’ve described, every 1% in Treasury total borrowing costs will crowd out 13% of discretionary spending, and this week’s latest Congressional Budget Office (CBO) forecasted a doubling of interest costs over their forecast horizon. A 2023 budget battle between the administration and a Republican House and perhaps Senate seems likely.