The Fed is a Slow Follower

The CPI two by four, the Fed's going to need a bigger mop, 60/40 foiled again

Rut Roh Rorge

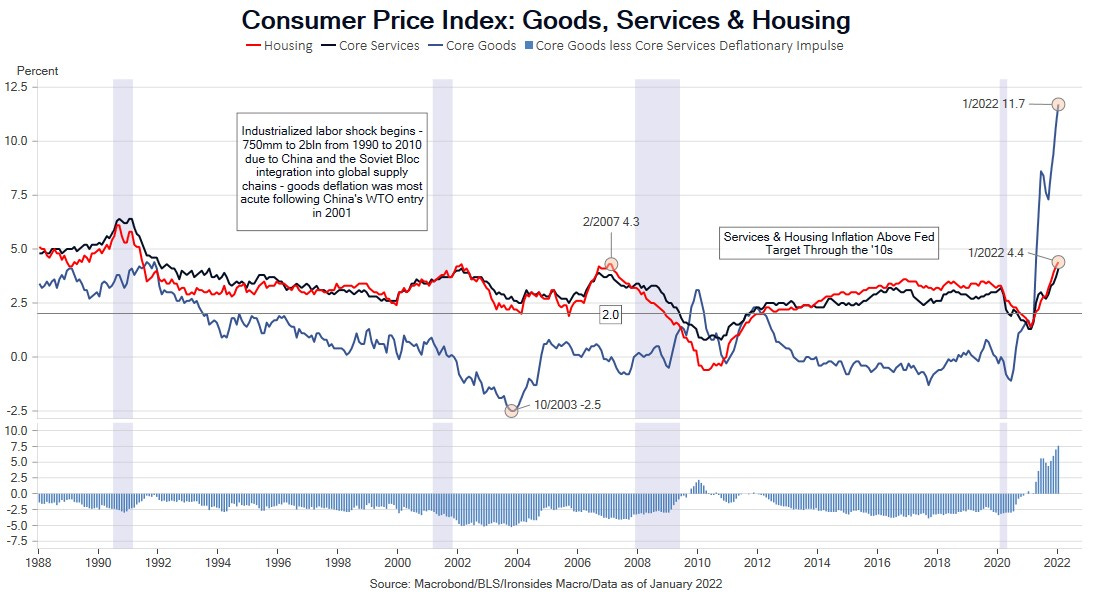

The January CPI report was another two-by-four across the collective foreheads of the FOMC. Two-year Treasury rates spiked 21bp on CPI Day, however the mix, a 22bp increase in the breakeven rate and 1bp decrease in the real rate (TIPS yield), hinted at market skepticism that the Fed would suddenly become a faster follower of the disturbing data. Further out the curve, beyond the 10-year, real rates led the increase in yields and the MOVE Index had a big day and followed through on Friday hinting that the probability of active balance sheet management had increased. The equity market was initially taking the number in stride, at least prior to St. Louis Fed President Bullard’s Bloomberg interview calling for 100bp of hikes by July 1 and balance sheet contraction beginning in 2Q. Bullard probably knows something, just as he did after the June 2021 FOMC meeting, though he is likely ahead of the rest of the Committee. We will do a deeper dive on the number later in this note, but in short, pandemic first order effects have not receded as evidenced by a 1.0% monthly increase in core goods prices that boosted the annualized rate to 11.7% from 10.7%. More concerning are the second order effects of the pandemic policy response that are contributing to accelerating core services inflation to 4.6% year-on-year from 4.0% in December. Transitory services disinflation is receding, this is best illustrated by medical care inflation that increased 0.7% from December, the quarter-on-quarter annualized rate jumped from 2.4% to 3.8%.