The Dog That Didn’t Bite

Low policy and earnings expectations, the earnings dog that didn't bite, new supply side economics, wage growth, a look back at the 2011 debt ceiling crisis

I am on the Host Committee for the 2023 Symposium on behalf of MacroMinds, which was founded by Dean Curnutt to bring the investment community together in support of causes that expand educational opportunities for students.

I wanted to share the impressive agenda for the 3rd annual event, taking place on June 7th in NYC. It should be an excellent day of content and interaction as we support education. Please reach out with any questions around attending or becoming a sponsor.

Note: We will be in NYC for most of next week, other than Wednesday in Boston.

Low Expectations

BIDEN STILL BELIEVES US SHOULD PAY FOR PAST DEBTS: SPERLING

BIDEN WILLING TO MEET MCCARTHY ON 'DRACONIAN' BUDGET: SPERLING

Bloomberg headlines Thursday midday

A week ago, expectations were exceptionally low for Speaker McCarthy, the fiscal outlook, corporate earnings generally and big tech specifically. In our analysis of the political calculus of rising debt and deficits in the ‘90s and ‘10s, we concluded public support for fiscal discipline leads to less profligate policy and favorable political outcomes for the party pushing for discipline. Consequently, we thought expectations for GOP passage of their debt ceiling bill were too low. In response to a Substack chat post about GOP House surprise passage, a reader asked if the outcome was positive or negative for equities. Given that passing the bill was only step one, it is too soon for optimism about the long-term fiscal outlook. In the near term, a surge in Tax Day receipts may have pushed the deadline from early June to July, which could keep the abundant liquidity environment in place though 2Q. The Administration responded that they would refuse to discuss the debt ceiling but will meet on the budget, which is a distinction without a difference.

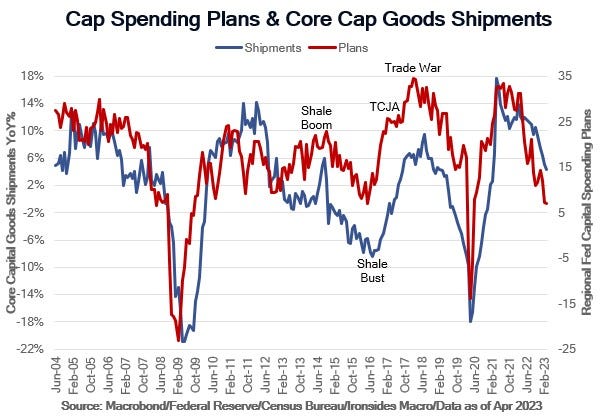

Incoming data this week was mixed and probably left the Fed on track for another misguided rate hike. GDP was weaker than expected, however the miss was primarily attributable to a sharp drop in inventory investment to the long-term trendline. While core domestic demand was robust, consumption was boosted by an increase in auto supply. There was ample evidence from earnings reports that consumption is slowing. Weak equipment and software capital investment dampened the outlook and highlights our view that overly restrictive monetary policy is impairing supply. The effect of policy on supply was evident in strong new home sales, weak pending home sales of existing homes and a surprising increase in the Case Shiller 20-City Composite House Price Index. The March personal consumption deflator report was favorable, our calculation of core services less rent of shelter was 2.9%, softer than February’s 3.1% reading. The employment cost index was hotter than expected for the quarter, but on an annualized basis it eased marginally and private sector wage growth of 5.07% is right on top of the nonsupervisory average hourly earnings series, thereby making the quarterly increase in the Atlanta Fed Wage Tracker an outlier.

Simmering in the background of the earnings and macro data barrage was First Republic Bank’s Q1 earnings report that made it clear their assets and liabilities are upside down, underscoring that the risk of a nonlinear tightening of credit is far from mitigated. The FOMC appears determined to increase the policy rate another 25 basis points. New-Keynesian demand models attempting to quantify the impact of tighter credit are dependent on unstable relationships. Forecasts of the impact of reduced credit on residential investment, labor income, consumption and prices, based on a couple of post-war credit contractions, are highly uncertain. On the other hand, we know with certainty that the $1.75 trillion of banking system USTs and $900 billion of mortgage-backed securities purchases in ‘20 and ‘21, financed at a 4.75-5% policy rate, is unsustainable for all but the Fed. In other words, the equilibrium policy rate for the household and nonfinancial corporate sectors are unknowable, but for the banking system the current policy rate is overly restrictive. While 25bp might not seem like much to the FRB/US model, a 5% policy for longer will accelerate the bank deposit beta, leading to increasing unstable and expensive liabilities, forcing more banks to shrink their assets.