Cleaning Up the Industrial Policy Mess

The Difficult Transition from Industrial to Supply Side Policy, the Increasing Probability of a Growth Scare Correction in Equities and Rally in Treasuries

Note: We will be in NYC March 4th-6th, we have a handful of time slots for meetings with institutional investors available.

Cleaning up the Mess

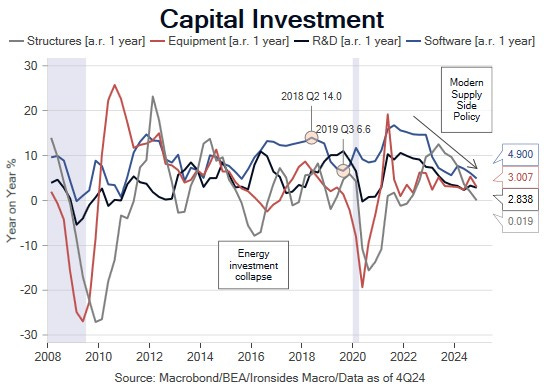

The transition from Treasury Secretary Yellen’s modern supply side industrial policy economics that led to persistently slowing nonresidential fixed investment, most notably in intellectual property products, to a resumption of the U.S. manufacturing renaissance theme driven by private sector investment, was never going to be seamless. As the House works on a budget resolution, followed by the ‘big, beautiful reconciliation bill’, and the DOGE team finding even more waste, fraud and abuse than the annual General Accounting Office report that members of Congress placed in the circular file under their desks each spring, it is looking increasingly likely that the Congressional Budget Office’s forecast of federal government outlays above 24% of GDP for the next decade is too high. While we are convinced that reducing spending and a lower budget deficit is the most important of Treasury Secretary Bessent’s Three Arrows, policy sequencing, and to an even greater extent, policy transmission channel variable lags, are likely to cause a soft patch in growth in the coming months that will cause a shift for investors from supply driven higher real rates, to a growth scare.

The fundamentals for a capital spending and productivity boom have been percolating in the background for more than a decade due to factors like the shale energy revolution, the buildout of the cloud infrastructure, diminished comparative economics advantage of global supply chains and more recent progress in generative artificial intelligence. The Tax Cuts & Jobs Act made the U.S. a more competitive destination for capital, but the shift to industrial policy and tighter regulation slowed the capital investment boom we’ve long expected, following the second weakest capital investment of the post-WWII business cycles during the ‘10s. We expect a durable acceleration of capital investment to develop over the course of ‘25, however, as we explain in this week’s note, the lags associated with stronger business confidence turning into capital investment that boosts productivity, margins and earnings, are longer than the impact of cuts to government spending and employment, at least in terms of the impact on growth and employment. Government spending and private sector investment are clearly not equivalent in terms of the impact on longer run potential growth, productivity, real wage growth and the general welfare, consequently, we are not concerned about the impact on earnings, but as we will discuss, equity analysts are less convinced than we are, and investors may get concerned about weaker GDP.

Additionally, as we discussed in last week’s note, although FOMC participants view the labor market risks are finely balanced, the collapse in churn and weak demand, particularly for the lowest income quartile and paid hourly workers, suggests the ‘equilibrium’ is unstable. A year ago, FOMC participants, seemingly dismissive of the fiscal theory of the price level, in other words convinced that inflation was always and everywhere a monetary, not a fiscal, phenomenon, were convinced disinflation was likely to persist and they were in a strong position to remove policy restrictiveness. This year, despite the potential for tighter fiscal policy, they are more worried about goods inflation from tighter trade policy (tariffs), despite China’s manufacturing producer price deflation. At the risk of sounding pejorative, they remind us of our Lehman Brothers trading floor contrarian indicators, a couple of traders that sounded fire alarms at market bottoms. We suspect the Committee will be back in easing mode by May.

In this week’s note we will discuss the potential catalysts for a soft patch in growth focusing on policy, macroeconomic and equity market micro to macro analysis and the investment implications.