Supply Chains Clearing onto Retailer Shelves

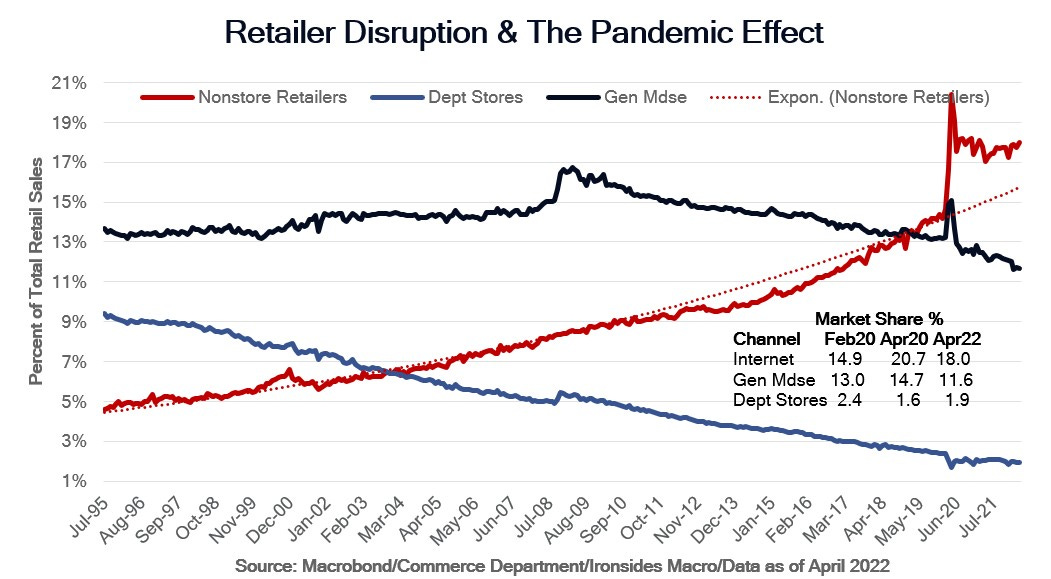

Walmart and Target provided a piece of the economic puzzle this week. We now know where the 20% monthly increase in goods imports in March went — straight onto their shelves. Demand did not collapse, it shifted within goods categories and from goods to services. Said differently, big retailers’ struggles are a micro data point in the peak goods inflation process, not a harbinger of a recession. While big retailer results were darkening the market mood, the Commerce Department’s April retail sales report, complete with the annual revisions, showed the control series (ex-autos, gas and building materials) increased at a 15.7% annualized rate from January through April. While some have dismissed the strength noting the series is not adjusted for inflation, core goods price inflation slowed sharply over the same period to a 3.6% rate implying real sales of 12.1%. The St. Louis Fed FRED database uses headline CPI to estimate real retail sales. While that makes sense for the headline series that includes food and energy, a more appropriate technique for the control series is to deflate goods demand with goods prices. The unrevised data showed demand slowing through 1Q22, while revised data shows no deceleration, rather continued strength and interestingly, significantly higher market share for ecommerce. The bottom line is that the inventory problems for Walmart and Target did not justify a 4% drop in the S&P 500, in fact we believe Wednesday’s slump was a large overreaction.