The Case for Ending Reinvestment

FOMC Meeting Preview and Market Outlook Update

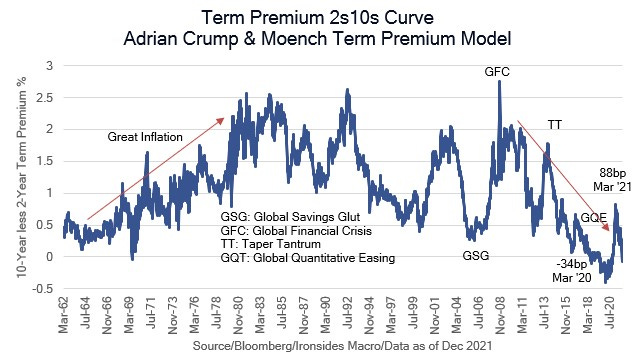

Prior to the November FOMC meeting, we characterized the Committee as handcuffed by their process, policy and politics. In the communique, they made an optionality assertion with respect to the pace of reduction in large-scale asset purchases. We thought the data would justify exercising that option to accelerate the taper and when the Biden Administration acquiesced to the politics of inflation and nominated Chairman Powell for a second term, the path was cleared to end asset purchases in March to create additional policy optionality. Inflation and employment data made the case to increase the pace compelling. If the Fed was intending to tighten financial conditions after the initial taper confirmation at the November 3 meeting and subsequent speeches and testimony that effectively preannounced a doubling of the taper pace, they are failing. Since the November FOMC meeting the real rate curve (TIPS yields) is lower across the curve with the exception of 5-year TIPS where their policy has the most direct impact. Additionally, the 2s10s nominal curve has flattened by 30bp to 0.80% and the 5s30s curve is 20bp flatter at 61bp. Term premiums for longer maturities are falling. They need to change their normalization sequencing from taper, hike, balance sheet contraction to taper, shrink, then hike. This approach is likely under consideration.