The Big Bond Week

Quadrilemma crunch time, Mixed earnings thus far, Unfavorable GDP mix, QRA & FOMC belly ache, Vol market kind of complacent

Crunch Time for the Quadrilemma

All eyes are on the FOMC meeting on Wednesday, but unless the Chair abandons their optionality and preannounces the start date for rate hikes or changes to balance sheet reduction ‘running in the background’, the more impactful policy event could be the Treasury’s Quarterly Refunding Announcement (QRA). On Monday, Treasury will announce their revised estimate for 1Q24 financing needs as well as their first estimate for 2Q24. On Wednesday they will announce the specific maturities of their issuance plans.

The August QRA revealed an additional $500 billion of financing for 2H23, an announcement that kick-started nearly 3 months of bear steepening that culminated with 10-year USTs breaching 5% for the first time since the financial crisis. In October, the QRA was the first step in reversing the sharp move higher in longer maturity yields. The FOMC’s policy put, a series of speeches acknowledging higher real rates were a substitute for additional rate hikes, followed by confirmation that the hiking cycle was complete (policy pause), combined with the Yellen Treasury shortening the duration of supply, stopped the bear steepening risk-off episode in its tracks. With $815 billion in the Treasury General Account (TGA), Treasury has the flexibility to maintain the current structure of bill issuance above the advisory committee (TBAC) recommended level. However, the bill issuance is draining liquidity from the Fed’s RRP program and may force the FOMC to slow balance sheet reduction (QT), leaving them with a much larger balance sheet than pre-pandemic. With mark-to-market losses over $1 trillion and negative cash flow greater than $100 billion, the politics could prove toxic.

We are hopeful we do not have to sit through 45 minutes of reporters asking Chair Powell, phrased differently each time, about the timing of the first rate cut — in other words Einstein’s definition of insanity. Instead, we hope they draw out some details of the QT discussion we expect to occur and where the Committee stands on Vice Chair for Supervision Barr’s increasingly controversial capital proposal. Additionally, clarity on the mix of disinflation, growth relative to potential and labor slack required to begin reversing at least the last three excessive hikes would be useful, but the Chair is unlikely to provide this level of detail. By the end of the press conference, we expect investors focused on the timing and magnitude of rate cuts to be unsatisfied. Beware of investors claiming the timing or number of cuts doesn’t matter, the 3m10y curve remains deeply inverted, and as such is a major challenge for all but the very largest banks. The household and portions of the nonfinancial corporate sector are increasingly reliant on expansive fiscal policy, for small banks and businesses credit is tight.

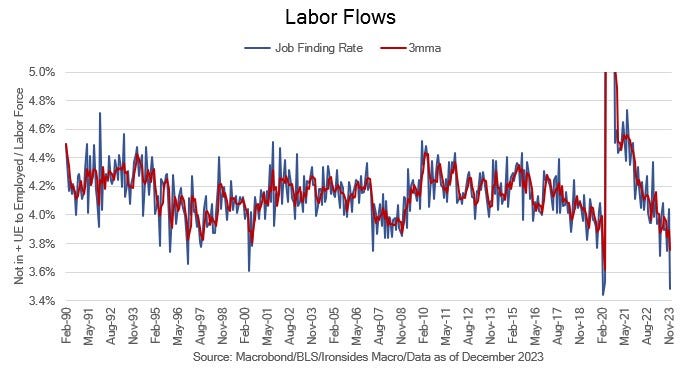

Friday’s December employment report could restart the process of resolving the quadrilemma: a 4% policy rate that keeps the 10-year yield in the vicinity of 4% requires an unemployment rate above 4% and wage growth below 4%. We will release a more detailed employment preview next Wednesday, along with our initial thoughts on the FOMC meeting, but the big question for Friday is whether demand for labor or the supply of workers is easing faster. If participation recovers a portion of the sharp November decline and demand continues to weaken, a March cut could be back on the table.