Sufficiently Restrictive

The Fed is missing another turning point, it's about growth, not inflation

Following the important developments this week we decided to delay our year in review note a week, and instead focus on the inflation, growth and policy outlook. We will reflect on the year of the Fed from New York City next week.

The Inflation Outlook Improves, But Growth Concerns Intensify

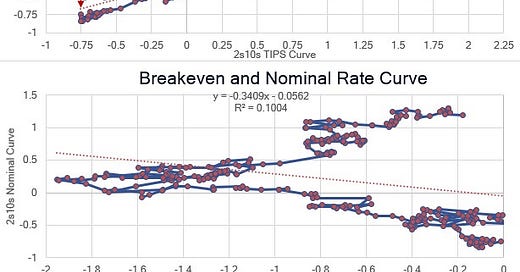

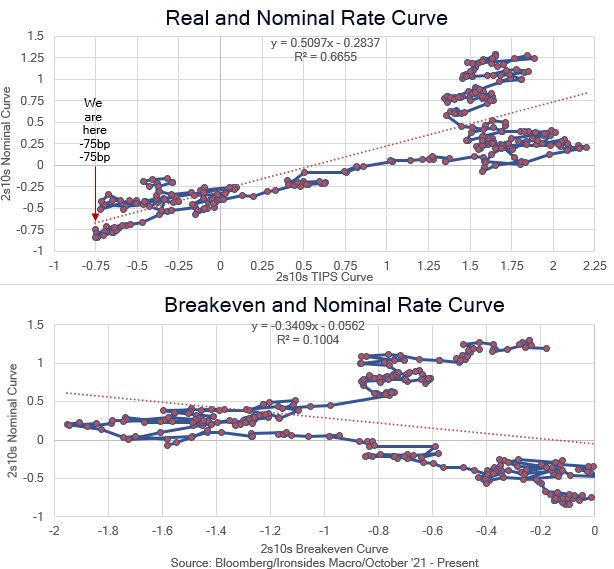

The primary message of this week’s price action in Treasuries and equities is that the markets have moved on from inflation to growth. This has been evident in our 2s10s nominal rates yield curve model for months. When the curve initially inverted in April it was driven by a deep inversion of the breakeven inflation curve, in essence the markets correctly forecasted peak inflation in the spring. As the Fed suboptimal tightening process unfolded, the correlation of the nominal curve to the breakeven inflation curve weakened while the relationship of the real rate (TIPS) curve to the nominal curve strengthened.

As we’ve discussed at length, these aren’t your father’s real rates. Fed holdings of ~1/3 of the TIPS, nominal Treasuries and mortgage-backed securities markets is suppressing rates, a recent KC Fed paper estimated 10-year Treasury rates were 160bp lower than they would be in absence of the stock of Fed holdings. Consequently, at the beginning of the tightening process the inversion of the TIPS curve had more to do with the combination of passive balance sheet contraction and aggressive rate hikes, with growth expectations a secondary factor. Now, with 2-year Treasuries below the policy rate, 50bp below their early November high and 85bp below the Fed’s terminal rate forecast, the 76bp inversion of the real rate curve, nearly identical to the nominal curve inversion, is all about deteriorating growth expectations. The 50bp increase in the FOMC’s terminal rate forecast appears targeted at increasing real rates to tighten financial conditions, with deterioration in the growth outlook the reason their forward guidance strategy is backfiring.