September Payrolls Preview

Less churn, jobs less plentiful, openings noise, cooling wages, intensifying instability

The Path to Long Maturity Rates Stability

We spent today discussing the path to stabilization in longer maturity real rates. The apparent BOJ intervention when the yen fell below 150 is an important event that should not be underestimated. Meanwhile a series of tin ear FOMC participant speeches exacerbated the pressure in the Treasury market. The most obvious road to stability runs through labor market data soft enough to end the rate hike cycle. The Job Openings and Labor Turnover Survey headline openings underscores the FOMC’s forward guidance straitjacket. As we will explain, the data looks highly dubious, and we saw analysis from a number of economists consistent with our view. Despite the contradictions in the JOLTS report, there was no stabilization in the back end of the Treasury (UST) market, because the labor market has to be unequivocally weak for an FOMC attitude adjustment. In other words, they made weaker growth the necessary condition to not hike in November.

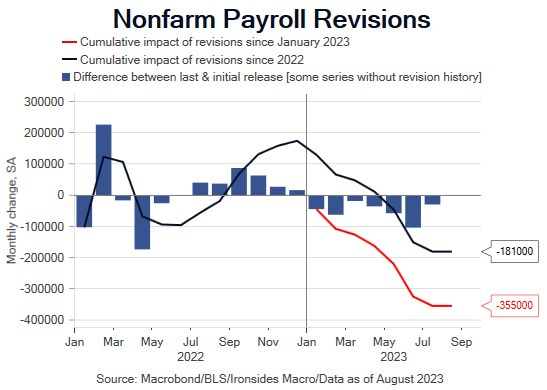

The Bloomberg survey of economist forecasts is a 170,000 increase in net total nonfarm payrolls, the range of estimates is 250,000 to 90,000 and 3-month average is 150,000. The U3 unemployment rate median forecast is 3.7%, following the 0.3% increase to 3.8% in August. The range is 3.9% to 3.6%, the FOMC summary of economic projections is 3.8% in December, hinting the Fed viewed the August increase as a statistical aberration. The final crucial aspect of Friday’s September report is average hourly earnings, consensus is 0.3%, the range is 0.4% to 0.2%, an inline number would leave the annualized rate at 4.3%. Guesstimating the change in net total nonfarm payrolls is an exercise in futility, 100,000 net payrolls is 6bp of the 156,000,000 total nonfarm employment. That said, there has been a negative net revision (the revise the prior two months as responses come trickling in) every month in 2023. We will take the under on the 170,000 median forecast. As we will explain, we have stronger conviction that unemployment is increasing, in other words the sharp increase in August was not a statistical quirk. Similarly, wage growth is likely to continue to cool. We will take the over on the expected 3.7% unemployment rate and under on a 0.3% increase in average hourly earnings.