Demand for Labor

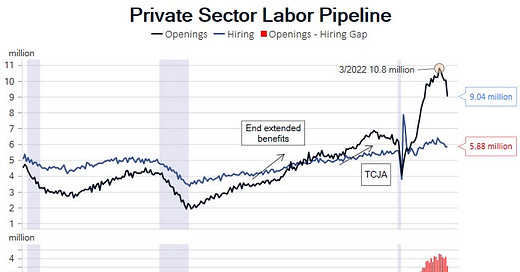

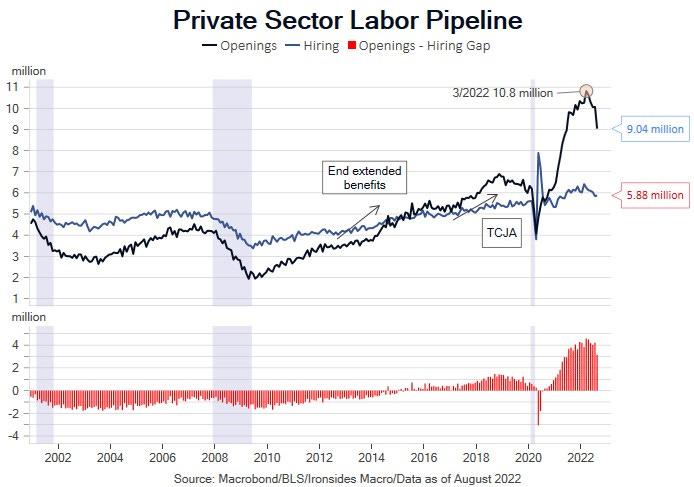

During the summer front loading of rate hikes, there was considerable uncertainty about the demand, supply and price for labor. That is no longer the case; demand is weaker, supply recovered, and the price is decelerating. FOMC participants will likely view the labor market as exceeding tight and an inflationary risk, however the turning point where the dual mandate regains balance is imminent. Friday’s report might not change their rhetoric all that much, but the combination of the midterm elections and current employment trends are highly likely to refocus the Fed on employment in 4Q. Expectations are for a 263,000 increase in nonfarm payrolls, below the 3-month average of 378,000 and 6-month average of 439,000. Consensus is for the U3 unemployment rate at 3.7%, all employees average hourly earnings increasing 0.3%, a 62.4% labor force participation rate, and 34.5 average weekly hours worked — all unchanged from August. The data we’ve seen for September are mixed: claims have been strong though we have questions about the seasonal adjustment factors due to a methodological change made during the pandemic that may no longer be appropriate. Employment components of regional Federal Reserve manufacturing and services surveys, as well as ISM manufacturing employment, were weaker. The Conference Board labor differential — jobs plentiful less jobs hard to get — increased two points but remains below the June 2020 to June 2021 range. The softening of the labor differential is completely due to a reduction in jobs plentiful, as respondents describing jobs as hard to get remain close to all-time survey lows. Finally, just before releasing this note the restructured ADP employment report showed 208,000 in September, from an upwardly revised 185,000 in August. ADP is no longer modifying their large database to match the BLS report, 208,000 in September is slower than the 308,000 6-month average in this series. The risk for Friday’s headline is for a lower report based on incoming data and trends, the risk to the markets is for a strong report that keeps the FOMC on track for another 75bp hike that could restart last week’s turmoil. Based on the trends we will discuss in this note, we expect softer demand, continued improvement in supply (participation) and a continuation of the wage deceleration trend.