Distractions

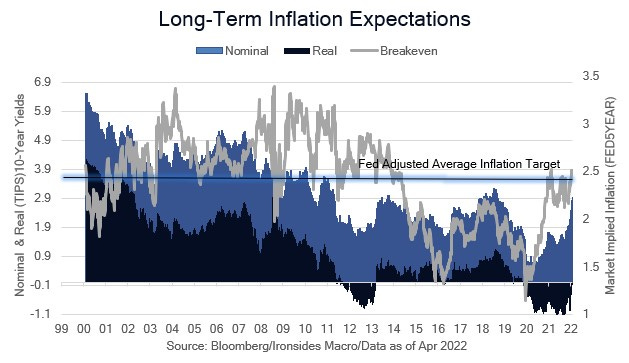

While the financial press was buzzing about Elon Musk’s Twitter overture, Netflix’s subscribers and Disney’s political quagmire, earnings results, macroeconomic data, cyclical sectors (transports, financials, industrials, materials and energy) strong relative performance early in the week and the implied terminal policy rate were all discrediting the recession theorists. The Fed noticed as well, and a series of hawkish speeches has moved guidance beyond 50bp and officially launching QT to debating a 75bp hike, a series of aggressive steps and front-loading tightening. The equity market response to yet another hawkish pivot was a highly correlated markdown that was essentially an aftershock from the January Fed policy normalization correction. The Treasury curve bear flattened in response to Fed speak, we continue to view their reliance on rate policy over balance sheet management as misguided and inefficacious. As 10-year Treasury yields neared 3% and 10-year TIPS approached zero, a couple of interest rate strategists decided to take a stand and recommended buying Treasuries. Given the spike in short maturity interest rate implied volatility, the spread of mortgages over swaps, negative convexity in the mortgage market (lack of refinancing risk), and sharp drop in the euro and yen, the relentless rise in Treasury rates could pause following the May 4 FOMC meeting. However, even if the Treasury market consolidates for a time, owning longer maturity Treasuries with negative term premia requires believing trend inflation will return to 1.5% by 2023.

Because we do believe the decades of goods price deflation is over, as global supply chains are restructured and the massive labor supply shock in the emerging world transitions to capital for labor substitution, the core personal consumption deflator — even with optimal monetary and fiscal policy (best case) — will be closer to prior cycles trend services inflation around 3%. Perhaps at 4%, depending on how fast core goods prices fall from peak pandemic supply chain disruption, the housing market’s response to sharply higher mortgage rates and the efficacy of our pandemic positive productivity shock thesis, Treasuries will represent a reasonable diversifying asset, if not value. With 10-year real rates (TIPS) approaching 0, a large portion of the equity market, technology and related as well as defensive sectors, are likely to remain under valuation related pressure regardless of the strength of earnings. Tactically, next week’s tech earnings, employment cost index (most important for the Fed) and 1Q22 GDP report loom large for the relative hawkishness of the Fed’s guidance. However, given the magnitude of the move in rates, rates implied volatility, and history of equity market responses to tightening cycles, it seems likely that the May 4 FOMC meeting will spark a relief rally in equities and Treasuries. Nonetheless, 3% 10-year Treasuries with TIP yields approaching zero, in the words of Lee Cooperman, Omega Family Office, offer ‘returnless risk’.