Return of the Bond Vigilantes

Resetting '25 Rate Cut Expectations, Political Calculus, Disinflation Deceleration, TCJA Research

Three Strikes for the FOMC’s ‘25 Rate Forecast

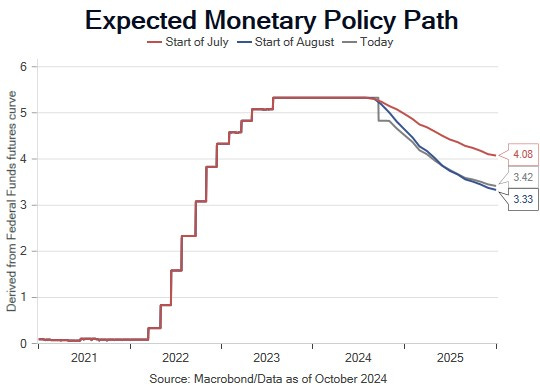

Since the FOMC’s surprise 50bp launch of the rate recalibration process the Treasury market has been hit by three major negative data releases. Strike one was the gross domestic income annual benchmark revisions, the second strike was the September employment report, and the called third strike was the 0.3% increase in September core CPI, primarily attributable to a 0.51% increase in non-housing services, the component of Chair Powell’s inflation framework most sensitive to wage growth. The increase in non-housing services prices increased our conviction that the period of disinflation is behind us, and prices will be less stable in ‘25. The combination of stronger growth and hotter inflation is unlikely to prevent the FOMC from continuing the recalibration to a 4% policy rate by December, in large part because the October employment report is likely to return to the softening demand trend. Additionally, we are ahead of the FOMC with our view that the 3-month soft patch in non-housing services CPI from May through July, just like ‘23, was transitory and fiscal policy continues to provide an inflationary impulse. The next meeting occurs prior to the release of October CPI, for now the Committee appears anchored to their ‘inflation is headed to target’ outlook. However, as we will discuss in this week’s note, in our view, the disinflation and falling inflation volatility trend has bottomed making the FOMC’s forecast for a 3% policy rate at year-end ‘25 contingent on weaker growth and higher unemployment than they expect. In short, the FOMC’s outlook was overly dependent on disinflation, and trend that appears to be ending.