Relief Rally in Everything

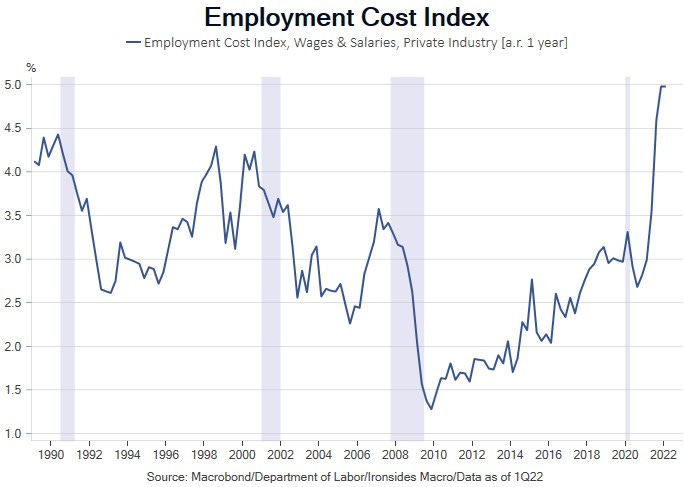

As hard as strategists, economists, portfolio managers and the financial press have tried to complicate the markets narrative, the explanation for negative stock and bond returns and weakness in the Chinese, Japanese and European exchange rates is obvious: it’s the Fed. Since the March FOMC meeting when the Fed considered beginning the normalization process with a 50bp hike but only went 25bp due to concerns about the Russian Invasion impact on growth, they have pivoted towards front loading rate hikes and preannounced more aggressive than expected balance sheet contraction (QT). Incoming domestic data, including Thursday’s advanced 1Q22 GDP, while hinting at some relief for goods inflation due to surging goods imports, has likely strengthened the Fed’s conviction that core domestic demand is robust and their model for the inflation process — wage growth driving expectations higher leading to more inflation — is a significant risk. Friday’s 1Q22 employment cost index beat on the headline, and private sector wages & salaries held at 5%, a record level keeping the Fed on track to front load policy tightening. Earnings results from Visa, Mastercard, American Express and big tech showed robust demand, but ongoing inflationary pressures. The issue for both equities and rates, that is still not resolved despite the negative year-to-date returns, is that the pandemic monetary policy response, the most aggressive policy easing since WWII, led to extreme valuations. This is not true of the entire equity market, as cyclical sectors remain reasonably priced, however, cyclicals struggle in the midst of Fed policy tightening corrections as equities transition from the early cycle environment of rising earnings and multiple expansion to midcycle with less favorable monetary policy.