Please listen to our weekly podcast summarizing our September 7 note and consider becoming a paid subscriber, if you are not already, to read the full report. If you are a recent free subscriber and would like a 30 day trial, please email me at bcknapp@ironsidesmacro.com

Only the Fed Can Save Us

After returning home from a television appearance this week, I had the following conversation with my wife.

Debbie: You were great today (she is a supportive wife). Everyone agreed with you.

Me: That’s not good.

Debbie: No, they all agreed with you, why isn’t that good?

Me: It means I am probably wrong.

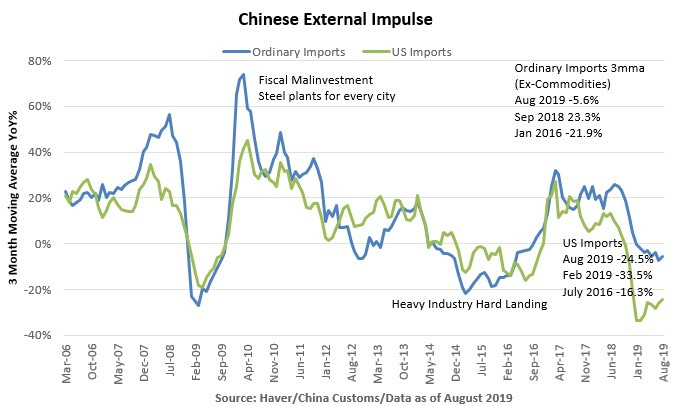

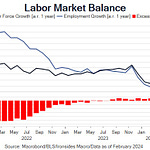

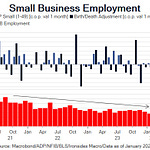

This week’s August private sector employment growth, August ISM manufacturing, July construction spending, July German Non-EU capital goods orders, August global PMIs and South Korean exports were all weak and consistent with our view that the trade war has tipped the secular downtrend in global trade into recession and stopped 2018 US capital spending boom in its tracks. Perhaps because of the consensus around the view highlighted in the discussion with my wife, the equity and credit markets took their cue from economic surprise indices, robust auto sales, a strong ISM non-manufacturing survey and firm average hourly earnings growth. With equities within a couple of percent of the highs and credit spreads near their best levels, these markets are discounting a 2016 scenario when the Fed stopped quantitative tightening and the US economy shrugged off a collapse in oil prices, Chinese heavy industry hard landing, 25% increase in the trade weighted dollar and an earnings recession.

In reality the US economy did not really shrug off the Chinese heavy industry hard landing and oil price collapse. Two of our preferred measures of growth to forecast the business cycle and corporate earnings and revenues; gross domestic income and final sales to private domestic purchasers fell 4.7% and 3.8% from the 2014 peak leading to a 5.8% plunge in S&P 500 revenue growth to -1.6%. Those same measures are 1.4%, 2.2% and 3.7% off their 2018 peaks through 2Q19. While we continue to believe that the second Chinese malinvestment bust in five years will not send as large a negative shock to the rest of the world as the first, despite the improvement in economic surprise indices for emerging markets and China, we do not see any evidence that global trade is stabilizing let alone recovering. Additionally, while the recovery in equities and credit in 2016 was initially driven by a reversal in 2015’s quantitative tightening, this week’s global government bond market selloff hinted that markets may be too far in front of monetary policymakers at least in the near term.

Suggested Reading from the Federal Reserve Research Staff…

https://www.federalreserve.gov/econres/notes/feds-notes/does-trade-policy-uncertainty-affect-global-economic-activity-20190904.htm

Barry C. Knapp

Managing Partner

Ironsides Macroeconomics LLC

https://ironsidesmacro.substack.com

908-821-7584

https://www.linkedin.com/in/barry-c-knapp/

@barryknapp

This institutional communication has been prepared by Ironsides Macroeconomics LLC (“Ironsides Macroeconomics”) for your informational purposes only. This material is for illustration and discussion purposes only and are not intended to be, nor should they be construed as financial, legal, tax or investment advice and do not constitute an opinion or recommendation by Ironsides Macroeconomics. You should consult appropriate advisors concerning such matters. This material presents information through the date indicated, is only a guide to the author’s current expectations and is subject to revision by the author, though the author is under no obligation to do so. This material may contain commentary on: broad-based indices; economic, political, or market conditions; particular types of securities; and/or technical analysis concerning the demand and supply for a sector, index or industry based on trading volume and price. The views expressed herein are solely those of the author. This material should not be construed as a recommendation, or advice or an offer or solicitation with respect to the purchase or sale of any investment. The information in this report is not intended to provide a basis on which you could make an investment decision on any particular security or its issuer. This material is for sophisticated investors only. This document is intended for the recipient only and is not for distribution to anyone else or to the general public.

Certain information has been provided by and/or is based on third party sources and, although such information is believed to be reliable, no representation is made is made with respect to the accuracy, completeness or timeliness of such information. This information may be subject to change without notice. Ironsides Macroeconomics undertakes no obligation to maintain or update this material based on subsequent information and events or to provide you with any additional or supplemental information or any update to or correction of the information contained herein. Ironsides Macroeconomics, its officers, employees, affiliates and partners shall not be liable to any person in any way whatsoever for any losses, costs, or claims for your reliance on this material. Nothing herein is, or shall be relied on as, a promise or representation as to future performance. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Opinions expressed in this material may differ or be contrary to opinions expressed, or actions taken, by Ironsides Macroeconomics or its affiliates, or their respective officers, directors, or employees. In addition, any opinions and assumptions expressed herein are made as of the date of this communication and are subject to change and/or withdrawal without notice. Ironsides Macroeconomics or its affiliates may have positions in financial instruments mentioned, may have acquired such positions at prices no longer available, and may have interests different from or adverse to your interests or inconsistent with the advice herein. Ironsides Macroeconomics or its affiliates may advise issuers of financial instruments mentioned. No liability is accepted by Ironsides Macroeconomics, its officers, employees, affiliates or partners for any losses that may arise from any use of the information contained herein.

Any financial instruments mentioned herein are speculative in nature and may involve risk to principal and interest. Any prices or levels shown are either historical or purely indicative. This material does not take into account the particular investment objectives or financial circumstances, objectives or needs of any specific investor, and are not intended as recommendations of particular securities, investment products, or other financial products or strategies to particular clients. Securities, investment products, other financial products or strategies discussed herein may not be suitable for all investors. The recipient of this report must make its own independent decisions regarding any securities, investment products or other financial products mentioned herein.

The material should not be provided to any person in a jurisdiction where its provision or use would be contrary to local laws, rules or regulations. This material is not to be reproduced or redistributed to any other person or published in whole or in part for any purpose absent the written consent of Ironsides Macroeconomics.

© 2019 Ironsides Macroeconomics LLC.

Podcast: Payrolls & The Convexity Comeback