Peak Policy Pessimism

Hayek's knowledge problem and the bond vigilantes were the catalysts for peak policy pessimism, but the economic fallout from the confidence shock begins this week.

We will be in Boston next Wednesday and Thursday and NYC the following Monday

Talking About Talking

In a discussion on CNBC's The Exchange hosted by Kelly Evans, we pushed back on Adam Posen’s of the Peterson Institute for International Economics, an economics think tank generally supportive of reduced barriers to trade, assertion that China had the upper hand in Trade War II (our characterization, not Posen’s) because they have been planning for a decade. The argument we articulated on TV that China’s hand was not strong focused on China’s export dependency, excess capacity, producer price deflation and unwillingness to restructure their economic model to increase domestic demand. An even more compelling argument comes from F.A. Hayek’s “The Fatal Conceit” when he posited central planners fatal flaw was a belief that a single authority can possess and process enough knowledge to effectively organize a complex society. While we are convinced China does not have the upper hand, it seems increasingly likely the Trump Administration is suffering from its own fatal conceit by overestimating its knowledge and ability to organize an even more complex system, specifically global goods trade.

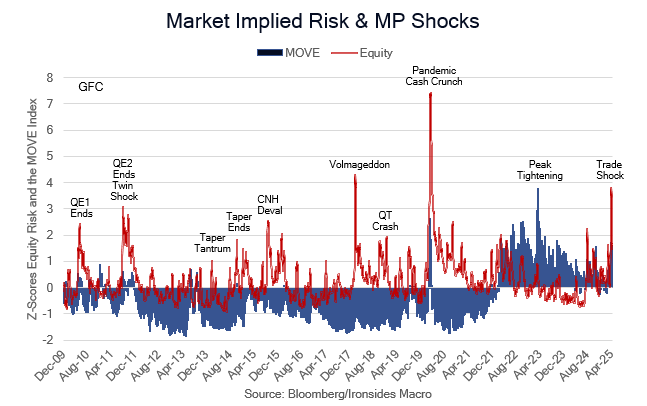

In other words, on Liberation Day, and with the follow-up Chinese retaliatory tariffs, President Trump over played his hand as evidenced by the equity and fixed income market’s reaction to 25% tariffs. As Fed Governor Waller detailed in his speech A Tale of Two Outlooks and in a Bloomberg TV interview on Thursday, the economy can probably absorb the 10% global tariff, but the fallout from the 25% trade surplus penalties, if they are implemented after the cooling off period, will render those tariffs a weapon of mass destruction in China and the US, with fallout across global supply chains and possibly the balance of President Trump’s agenda. The good news is, unlike the prior administration, President Trump’s economic team, led by Treasury Secretary Bessent, knows how to listen to markets, consequently, Treasury, equity, and exchange rate market’s rejection of the 25% tariff outcome will force the outcome towards our 10% global tariff base case forecast.

We suspect the breathless reporting on trade policy, exacerbated by establishment aversion to disruption, has led many to forget that we just absorbed an even bigger global goods and services supply shock five years ago. During what we believe was the greatest policy blunder(s) in our 40-year professional life by federal, state and local policymakers, the private sector proved far more dynamic and resilient than the markets implied during the markets crash in February-March ‘20. As we’ve discussed in our last couple of notes, of the two closest ‘sudden stop’ policy driven recession analogs, the 1980 Carter Credit Controls and 2020 Pandemic Panic, the impact of Carter’s credit restrictions on business confidence led to a reversal after 4 months, which limited the depth of the growth and earnings contraction, and mostly closely approximates the current policy shock. Like Carter, the Trump Administration is being forced to throttle back their policies.

In last week’s note, The Fed is Fattening the Recession Tail, we previewed a week of policy, economic and earnings limbo that we suggested was likely to lead to weakness in equity and Treasury prices. While Monday’s price action and Tuesday’s weak 2-year note auction validated our outlook, the recovery over the balance of the week suggested our call on April 5 in The Trump Trade Shock that we were at peak policy pessimism, was correct and the 4835 S&P 500 low on April 7 looks fairly safe.

In this week’s note we will focus on previewing the crucial policy, economic and earnings events next week.