Payroll Preview: Productivity Dividend

Excess Demand, Peak Slack and Wages, Productivity Dividend, Participation & Hours Worked

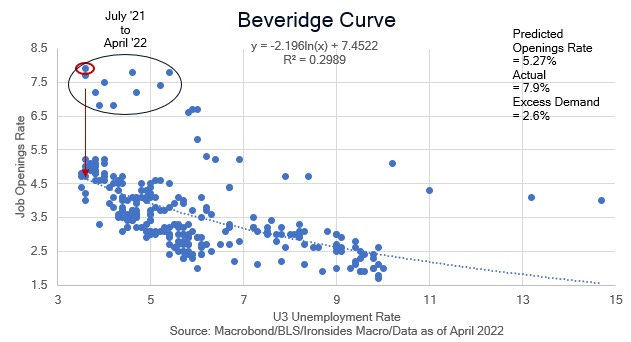

Excess Demand

Fed Governor Waller’s speech in Germany Monday got a considerable amount of press due to the portion of the speech focused on monetary policy. What the speech was really about was a defense against criticism from Keynesian economists (Summers, Furman, Dudley, etc.) that inflation will not slow without an increase in unemployment. Waller’s view is that tighter monetary policy may not increase the unemployment rate due to excess demand. In other words, hiring will slow but given the historically tight market, layoffs will not increase until the surplus of job openings is worked off. This same concept can be applied to housing and autos where demand far exceeds supply. Until last week investors were overly concerned about monetary policy weakening demand leading to a recession, however if producers can’t meet demand due to supply constraints, weaker demand will not reduce sales or earnings (to a point).

Waller illustrated the point using vacancies and unemployment. Using the pre-pandemic relationship between openings and unemployment as our sample period when the r-squared was .61, the openings rate associated with a 3.6% unemployment rate should be 5.3%, not 7.9%. Waller’s view is a higher cost of capital that reduces demand for labor could reduce the openings rate by 260bp before the unemployment rate increases.

Responding to High Inflation, with Some Thoughts on a Soft Landing