Participation Trophy?

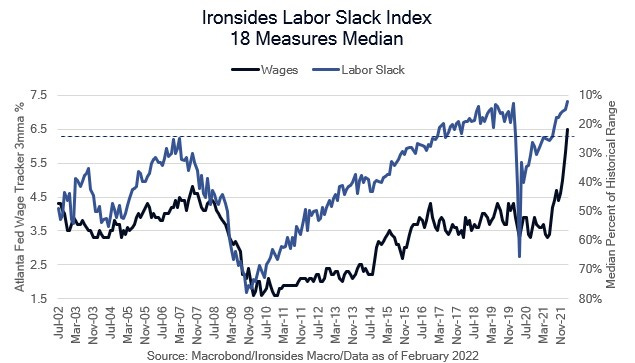

With the financial press buzzing about the flattening of the 2s10s nominal Treasury curve and associated risk of Fed policy tightening causing a recession, Friday’s March employment report is a crucial input into the Federal Reserve’s reaction function and the market implied growth outlook. Were equities struggling while the curve bull flattened, at least in the back end of the curve (10-year yields falling), then we would expect good (employment growth) to be good for equities. Instead, the 2s10s nominal curve is bear flattening and equities are rallying, though financials and homebuilders are lagging. Consequently, high frequency traders are likely to get burned on Friday because the devil is likely to be in the details of the March report. Strong employment with diminished slack and strong wage growth could nudge the Fed towards an acceleration of the policy normalization process. One plausible, albeit low probability, scenario where the Fed’s March forecasts for lower inflation without a sharp increase in unemployment are realized, is a surge in labor force participation. With a 50bp hike and start of balance sheet contraction hanging in the balance, labor force participation and nonsupervisory average hourly earnings are crucial inputs to the Fed’s reaction function. To get a snapshot of the growth implications of the report, our focus is total hours worked as the Omicron effect fades.