October Employment Preview

Wages heading lower, seasonal adjustment and small business overestimation flattering the data, lower churn, diminished slack, USTs on a knife's edge

Clarity, Don’t Bet on It

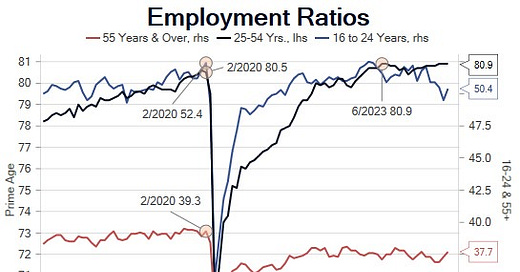

Characterizing the increase of 254,000 in September nonfarm employment, combined with a 72,000 positive revision to the prior two months, decline in the unemployment rate from 4.22% to 4.05% and 0.4% monthly increase in average hourly earnings, as surprisingly strong, is a major understatement. Our initial reaction to the September report was skepticism that the persistent ‘24 softening trend turned on a dime in September for several reasons. First, a decline in the work week to the cycle low led to a 0.1% monthly and flat quarterly annualized rate for the aggregate hours index, the broadest measure of demand from this report. Second, a sharp increase in the employment rate for the 16-24 age group from 49.5% to 50.4% during the month when summer ends and students return to school suggests the BLS seasonal adjustment factors were corrupted by school closures in ‘20 and ‘21. The increase in the rate for 55+ workers to 37.7% from 37.3% is less intuitive but looks curious as well. Finally, data from ADP and NFIB, as well as the first estimate of the annual benchmark revision (-818,000), strongly suggests the BLS is overestimating small business employment (as well as job openings).

“On balance, employment increased slightly during this reporting period, with more than half of the Districts reporting slight or modest growth and the remaining Districts reporting little or no change. Many Districts reported low worker turnover, and layoffs reportedly remained limited. Demand for workers eased somewhat, with hiring focused primarily on replacement rather than growth.” Beige Book - October 2024

Since the September employment report, incoming data hasn’t clarified picture. The Beige Book qualitative description of the demand for labor was reasonably soft. Jobless claims spiked early in the month and were 20,000 higher during the establishment survey week than in September. The increase was primarily, though not exclusively attributable to hurricanes and strikes as evidenced by continuing claims climbing to a three year high. These factors explain much softer expectations for an increase of 101,000 total and 70,000 private sector jobs. The October ADP report did not offer much clarity either due to a different approach to treatment of temporary layoffs than BLS. These issues suggest a soft report might be dismissed by market participants who on balance are inclined to give resilient growth the benefit of the doubt.

In this note we provide our perspective on recent labor market data and the implications for Friday’s crucial, but likely to be messy October employment report, as well as detailing our longer-term view that reduced churn implies cooler wage growth in 2025.