October Employment: Increasing Slack

The Fed's reaction function, increasing slack, Beveridge Curve, slowing wage growth and an October unemployment surprise

The Fed’s Reaction Function

Before delving into the state of the labor market ahead of Friday’s October employment report, we were asked the relative importance of inputs to the FOMC’s reaction function as it relates to the decision to slow the pace of hikes at the December FOMC meeting. Here is our response:

Inflation reports

a. Personal Consumption Expenditure Deflator (PCED) followed by CPI

b. Wage data - Employment Cost Index, Atlanta Fed Wage Tracker, and Average Hourly Earnings, in the that order

c. Inflation surveys - University of Michigan, NY Fed, Economist Surveys

Financial Stability

a. Treasury auctions and liquidity

b. Agency MBS spread to swaps/Treasuries

b. Exchange rates

c. Global sovereign bond markets

d. Real rate curves, inflation breakevens

Housing

a. House prices

b. Rents

c. Supply

d. Demand

Labor market - if and when the U3 unemployment increases to 4%, this factor moves to the top of the list

Said differently, with the U3 unemployment rate at the cycle low, the labor market is not a factor in our expectation the Fed is likely to provide a more balanced outlook tomorrow. Financial instability - mortgage spreads, fixed income volatility, Treasury liquidity, exchange rates for energy importers (Europe, UK, Japan and China) and global sovereign bonds - as well as plunging house prices and housing supply are strong reasons for the Fed to slow down.

Increasing Slack

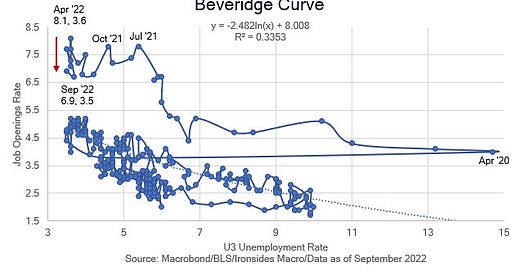

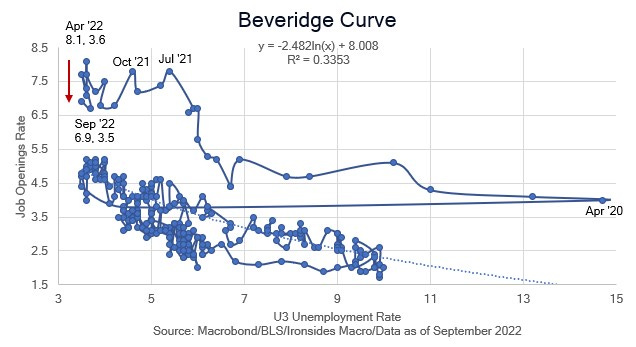

This morning’s September Job Openings and Labor Turnover report was a bit of a shocker due to an unexpected increase in openings to 10.717 million from an upwardly revised 10.28 million in August. Consensus was 9.75 million. While there is a fair amount of skepticism in the economics community about the efficacy of this data, the FOMC seems enamored with the vacancy rate. Consequently, the uptick in the openings (vacancy) rate was a negative data point ahead of tomorrow’s meeting. Even with the increase in the private sector openings rate from 6.7% to 6.9%, it still remains well below the April peak of 8.1%. Additionally, the quits rate ticked down from 3% to 2.9%, the peak was 3.4% in November 2021.